Mandatory Reporting of Cash Registers

Reports of electronic recording systems within the meaning of Section 1 (1) sentence 1 KassenSichV purchased before July 1, 2025 must be submitted by July 31, 2025.

The BMF letter also regulates the obligation to report EU tax parameters and odometers. The BMF provides a completion aid (Ausfüllhilfe) for the data collection of cash register data subject to reporting requirements.

Since January 2025, we have XML files containing the initial recorded data required to fulfil the reporting obligation, along with a download link. Direct access to the efsta Portal is not necessary to acquire the file, so anyone can process this data, regardless of their permissions or restrictions within the portal. You can also download the XML reporting obligation files yourself any time by logging into the efsta Portal or retrieving them automatically via API call using our portal API.

- The XML files must be processed manually by the taxable customer in MeinElster.

- For offline EFRs, there is no XML data export for MeinElster available. If you want you use the efsta reporting functions, please change to EFR online.

Furthermore, we inform all registered Elster contacts from the efsta Portal of any reportable changes or additions to their fiscalised cash register solution via a weekly email. These emails will enable you to download and check the XML data for your cash register report. All Elster contacts already entered in the efsta Portal will receive an email asking them to confirm their email address. The same process will be carried out for every newly registered Elster contact (GDPR compliance).

- The XML files are stored within the efsta Portal and will not be part of the notification email.

- If you have entered the same email address more than 5 times in the Elster contacts field at company level, we will combine all into a single message.

If you have any questions, please contact efsta support at ticket@efsta.eu

Solution Overview

Here is a short overview of the efsta solution to the mandatory reporting in Germany:

- Start by entering contact data for MeinElster in the company level of the efsta Portal

- Continue with verification or adjustment of mandatory reporting data in the efsta Portal or EFR

- Going forward, you will receive weekly mail service from efsta when changes are detected. The XML file with mandatory reporting data (gross method) is available as well

- Finally, download your completed XML file from the efsta Portal and upload it to MeinElster

Weekly Trigger Points

The following trigger points are checked by efsta on a weekly basis:

- An EFR (Electronic Fiscal Register) is created or closed

- Any new changes in the terminal level of the EFR, such as serial number, hardware etc. which are used to create an XML reporting file. Exception is the data field TT (internal efsta identifier), as it is not relevant for the report

- A TSE is activated or deactivated

- A location or registered office is added or deactivated

- Change of tax number: Attention - here the existing EFR instance must first be closed, the TSE must be deregistered, TSE data /TAR files, DSFinV-K must be exported and a new company must be created and reported in the portal including a new EFR -

Should you require more information on this, you can visit our FAQ page.

Please note that when using an offline EFR version, the legally required data is NOT transmitted to the efsta Portal and is therefore not available for a data export to fulfill the reporting obligation. In one of the next EFR versions we will offer an export of the TSE data - you will receive corresponding information via newsletter or blog post.

Validation & Reporting

In order to fulfill the reporting obligation, it is necessary to check and complete legally required data for exports in the efsta Portal. Data validation was completed with 1.10.24. The procedure is described below.

There are four options for data maintenance as well as for future data exports. These include reporting by:

- Partner

- Customer

- efsta's Automated System

- Independently

We recommend the mandatory data mentioned below to be maintained and transferred primarily via the efsta EFR / API.

Reporting Basic Work by Partner

The partner (cash register manufacturer or integration partner) is responsible for maintaining the customer's data, as well as the necessary information such as the type of POS system and the serial number of the POS system.

In order to use our reporting services, please provide an Elster email address at company level so that we can send the necessary information to your taxable customers to fulfill their reporting obligations.

Reporting by Customer

The taxable customer can manually upload the prepared XML files to MeinElster. They will receive an email notification to the Elster mail address saved at the efsta Portal.

Once all necessary data has been completed, the customer can download an XML file in the mandatory format and upload this to MeinElster. They are responsible for completing the necessary data and downloading the XML file. There is no need for access to the efsta Portal – the customer does not need any login data like a username or password. This means that after completing and checking the reporting data from the efsta Portal, each of the XML files of the location which needs to be transmitted must be exported and uploaded independently to the MeinElster account assigned to the company.

Automated Reporting

The taxable customer can opt for the automated fee-based reporting solution, whereby efsta forwards the XML files as a data processor to MeinElster.

Please note that the partner is responsible for adding all necessary information to ensure full compliance of the XML file.

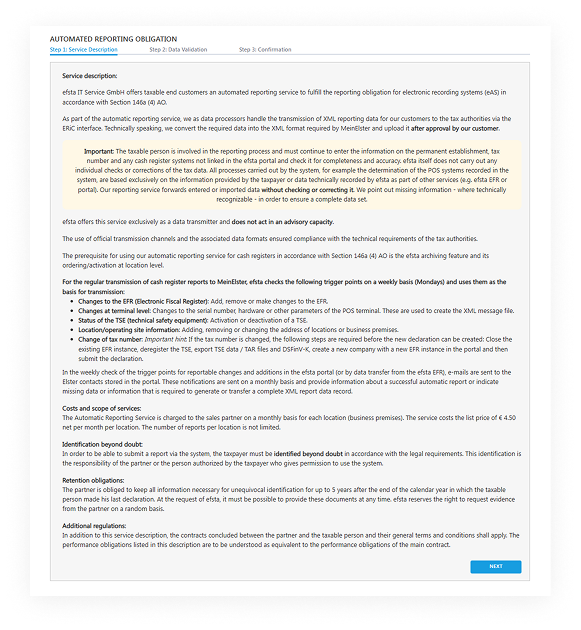

About the Automated Reporting

General Information

efsta offers taxable end customers an automatic reporting service to fulfil their electronic recording system (eAS) reporting obligations under § 146a, paragraph 4 of the German fiscalisation rules (AO).efsta offers this service as a data transmitter and does not provide any advisory services.

Using the efsta automatic reporting service, we transmit the XML reporting data for taxable persons via the ERiC interface and upload the required data to MeinElster in the required XML format. The taxable person must enter any missing information on the permanent establishment, tax numbers and cash register systems not connected to the efsta Portal, and check that it is correct.

Our reporting service will forward data entered or imported from the system without checking or correcting it; however, we will highlight any missing information to help you generate a complete dataset. As a data processor for end customers, efsta automatically transmits the relevant data collected via EFR middleware and the efsta Portal to the ‘MeinElster’ transmission channel specified by the tax authorities via the ERiC interface.

The use of the official transmission channels and the associated data formats ensures that the technical requirements of the tax authorities are met.

efsta does not carry out an individual check or correction of the tax data. All information provided by the system (e.g. the determination of cash registers reported in the system) is based exclusively on information provided by the taxpayer or data recorded by efsta during the provision of other services (e.g. efsta EFR or the Portal).

Process Details

The basic prerequisite for being able to use our automatic reporting service for cash registers in accordance with Section 146a (4) AO is the efsta archiving feature and the ordering / activation of the feature at location level.

As part of the weekly check of trigger points for reportable changes/additions in the efsta Portal (or via data transfer from the efsta EFR), emails are sent to Elster contacts stored in the Portal. These emails are sent on Mondays and indicate either a successful automatic report or data/information that needs to be added in order to generate or transfer a complete XML report data record.

The automatic reporting service is charged to the sales partner monthly per location (business premises). There is no limit to the number of reports per location.

Identification

In order for a taxable person to be able to submit their declaration via the system, they must be clearly identified in accordance with the legal requirements. The partner or the person authorised by the taxpayer, who releases the taxpayer to use the system, is responsible for the unequivocal identification.

The partner must retain all information necessary for unequivocal identification for up to 5 years after the end of the calendar year in which the taxable person made their last declaration. At efsta's request, the partner must be able to provide the documents at any time. efsta reserves the right to request evidence from the partner on a random basis.

Terms & Conditions

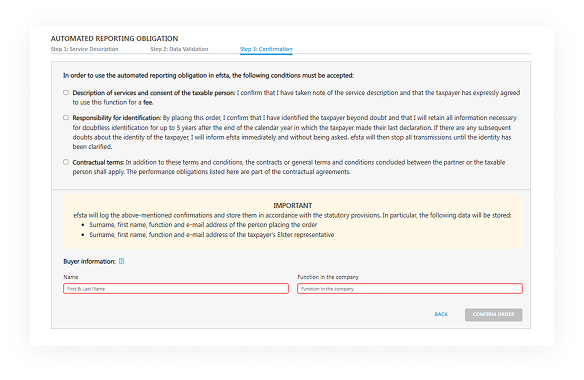

In addition to this service description, the contracts or general terms and conditions concluded between the partner and the taxable person shall apply. The service obligations listed in this description are equivalent to the service obligations of the main contract.Activation

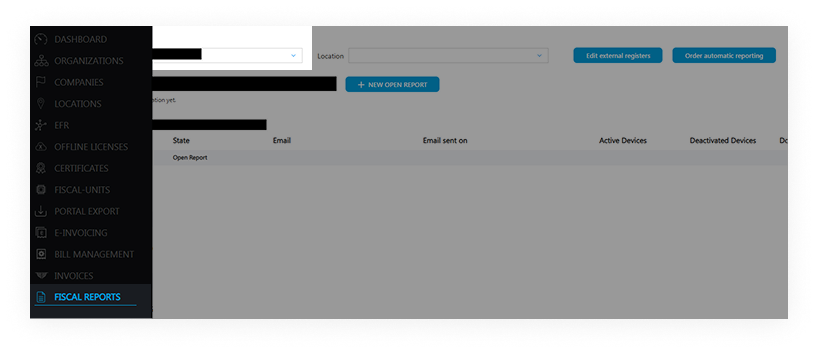

After enabling the automated service, you can activate it at the efsta Portal on a company level:

-

First, please navigate to "Fiscal reports" and select a company from the drop down

-

After clicking on „Order automatic reporting“ you can read the service description and confirm by clicking on „NEXT“.

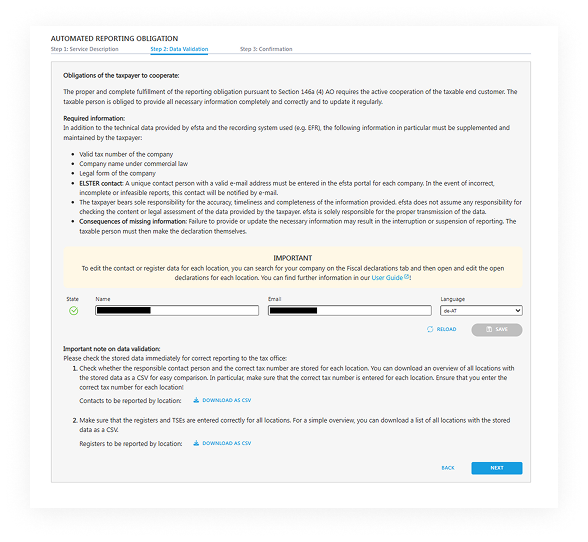

-

Then, please create a contact who will automatically receive information mails at the email address added here (we recommend a functional or departmental email address). Please note that the email address you enter must be confirmed via a link, which you will receive in a confirmation mail.

-

After confirming the email address, please click on „RELOAD“ in the portal.

-

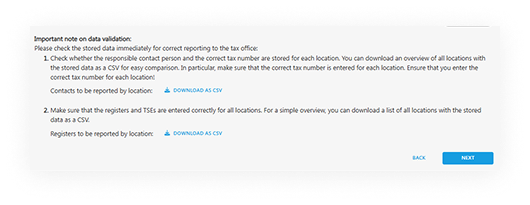

There are two downloads available:

Download contacts

The CSV file shows you which Elster contacts are recorded at which locations. If the fields are empty, please fill them in on the Portal at location level (if different personal data such as tax numbers are required) or at company level for all locations. Without the relevant data, no report can be created and you will receive an error message.Download location

In the second download, you will see the legally required data/fields presented in tabular form. This data must be checked and completed for each location! If data is missing for locations, no report file can be generated/transmitted – an error message will be sent to the Elster contact or by email (taxpayers' obligation to cooperate).

-

Finally, please enter your name and position in the fields provided and click on ‘Confirm order’. You will receive an order confirmation by email.

Notifications

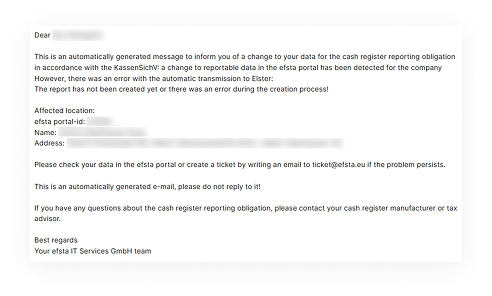

If you receive an email notification that the automatic report could not be completed successfully due to poor data quality, please follow the instructions in the email, check the report data for the specified location in the efsta Portal and complete it.

Once the data has been supplemented, a new data transfer to MeinElster will be started on the following Monday. Optionally, you can create this notification manually in the efsta Portal, then download it and upload it to MeinElster on your own responsibility (see end customer instructions).

Only do this if the one-month deadline for reporting new cash registers or changes within one month is at risk.

During our weekly check of data trigger points (have there been any changes that need to be reported), cash register reports are automatically sent to MeinElster by efsta as the data processor on Mondays. If the data transfer can't happen because some data is missing, you'll get an email notification for each location affected.

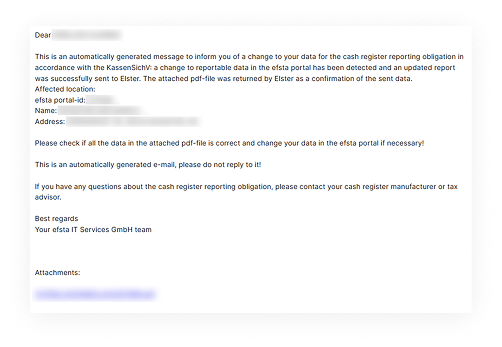

If a report has been successfully transferred by efsta as data processor, you will receive a confirmation mail (see screenshot). This email contains a link that you can use to download a PDF file approving the successful report. You can download this confirmation at any time from the efsta Portal under ‘Fiscal Reports’.

We recommend that you attach the current report to the procedural documentation.

Report Status

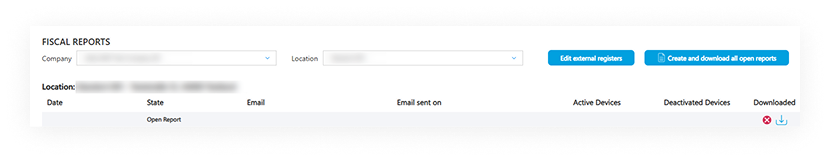

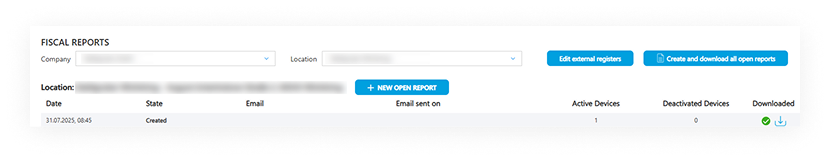

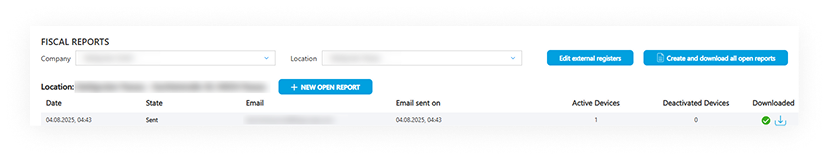

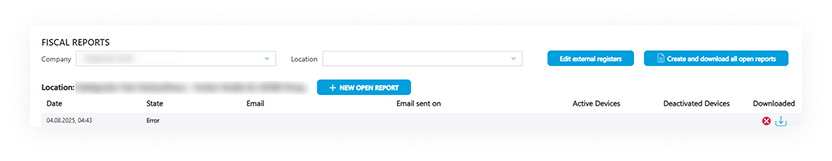

We provide four different statuses for MeinElster cash register reports in the efsta Portal:

- Open

- Created

- Sent

- Error

An "Open" report should be processed. It can be created manually, downloaded and then uploaded to MeinElster on your own responsibility (taxable customer). Alternatively, this is done automatically in efsta's weekly automatic processing report process.

If you have not ordered an automatic reporting service but you have stored an Elster contact in the Portal, you will always receive a reminder on Monday that there is a reportable data change in a location report (e.g. new TSE, new cash register serial number aso.) which requires a new manually uploaded report in MeinElster.

The status "Created" is only displayed to portal users who have manually created a cash register report. If you are using the automatic reporting service, you will only see the cash register reports that you have created manually.

The report files created here in XML format can no longer be changed in the efsta Portal. In the first step, you can access the report by clicking the ‘Download’ button. With the ‘Download report’ button, you can download the XML file for further processing in MeinElster. You can find more details on this topic at the end customer instructions.

The status "Sent" is displayed to portal users who use the automatic reporting service.

Once the transmission has been successfully completed, you will receive a confirmation message with a PDF download of the transmission log from efsta. Here you can see when the transmissions were successfully completed for each location.

If necessary, you can download these messages for your own archiving purposes by clicking on the ‘Download’ button. All successful messages are automatically archived in the Portal in an audit-proof manner.

The status "Error" is displayed to Portal users who use the ‘Create and download all open reports’ button or the automatic reporting service but still have locations with incomplete data. No report can be created here due to missing data. The data must be supplemented by the taxpayer (the taxpayer's obligation to cooperate must be observed here).

As part of the weekly automatic processing system (always on Mondays), a new open report is always automatically generated after an error, with a request to complete the data.

Follow the end customer instructions to correct potential sources of error such as the format of the tax number or missing data.

Once all data fields have been filled in, a new open notification can either be created and processed manually or automatically transferred via the weekly processing system.

If your taxable customers are interested in the feebased automated reporting solution, please get in touch with your partner manager to enable this service on the efsta Portal.

Independent Reporting

The partner or their taxable end customer fulfills the reporting obligation on their own and does not use the reporting service offered from efsta.

Essentially, it is the merchant's or taxpayer's own duty to report the relevant cash registers to the tax office. Alternatively, the taxpayer can also authorize someone to do the reporting.

Please note that efsta is available to you as a partner for support requests, but we do not provide end customer support! Inquiries from your taxable end customers are your responsibility according to the partner contract in 1st level support.

Data Maintenance

In order to ensure successful reporting, a few steps must be taken first:

- Manage Elster contact information

- Manage location data

- Manage company data

- Manage terminal data

Elster Contacts

First, please add an email address in order to transmit the legally required XML files for reporting in MyElster. Either an email address of the taxable customer (for the transmission of future reporting data or in the event of changes to reporting obligations) or of the partner company is entered here. In the latter case, you as a partner will receive the XML files needed for obligatory reporting instead of the taxable person (see Reporting by Partner and Reporting by Customer above).

We recommend using general company mailboxes such as "accounting@company.de" instead of addresses from individual employees. This is to ensure the data can be delivered, even when personnel is changed.

Since the company data or contact details can be completed by the efsta partner and/or the taxable end customer, we offer two options of data maintenance:

- Direct adjustment in the efsta Portal (at company level)

- Data export and subsequent import via CSV files (at organisation level)

This means, depending on the permissions, users can either use the option to supply information for each company individually through the efsta Portal, or export all customer data on an organisational level by downloading an export of the current data, adjusting it and then reuploading the new CSV file in order to change data for multiple companies at once.

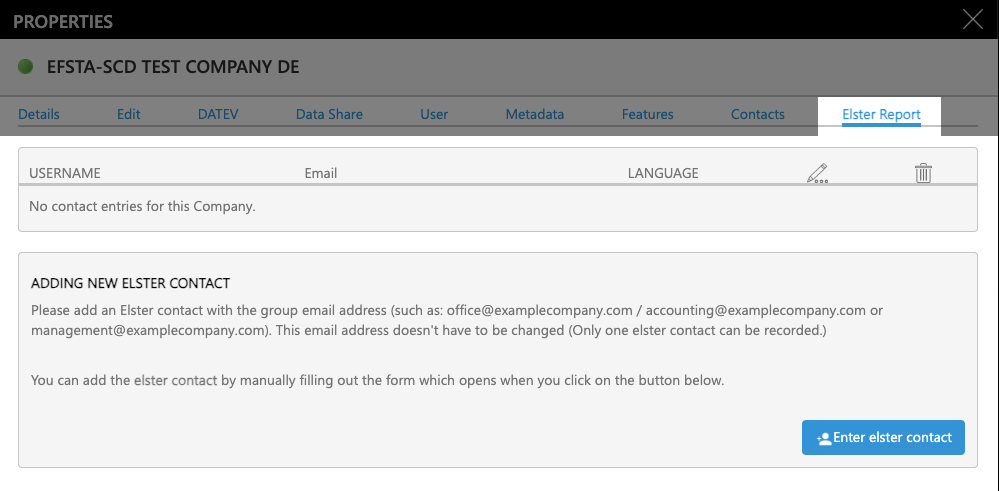

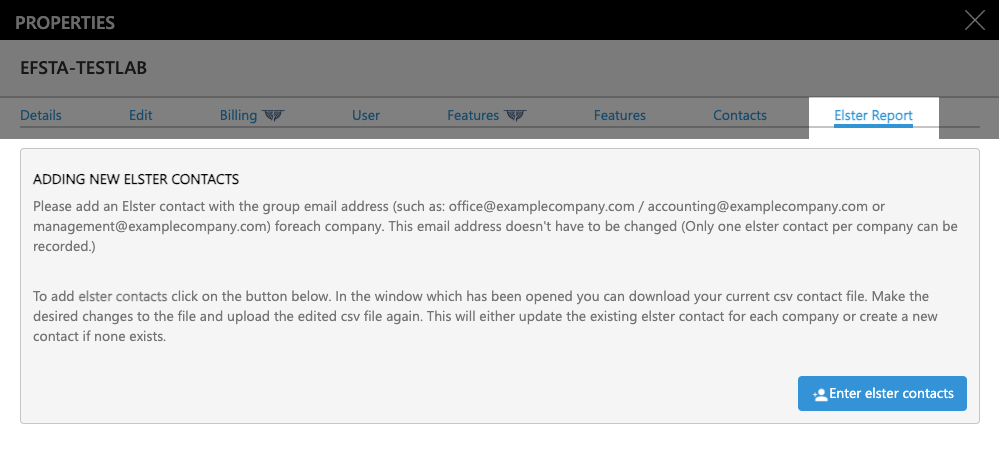

Management on Company Level

With this option, the contact information of taxable customers is reviewed or supplied directly via form in the efsta Portal.

-

Navigate to "Companies" on the left-side navigation

-

Select the company name or click the symbol with the three dots on the right side of the appropriate company

-

Proceed by navigating to "Elster Report"

-

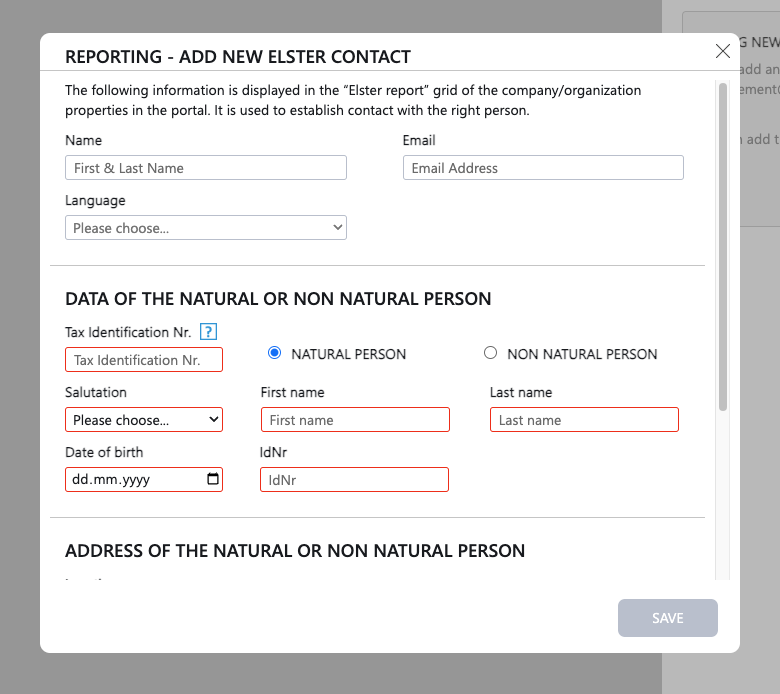

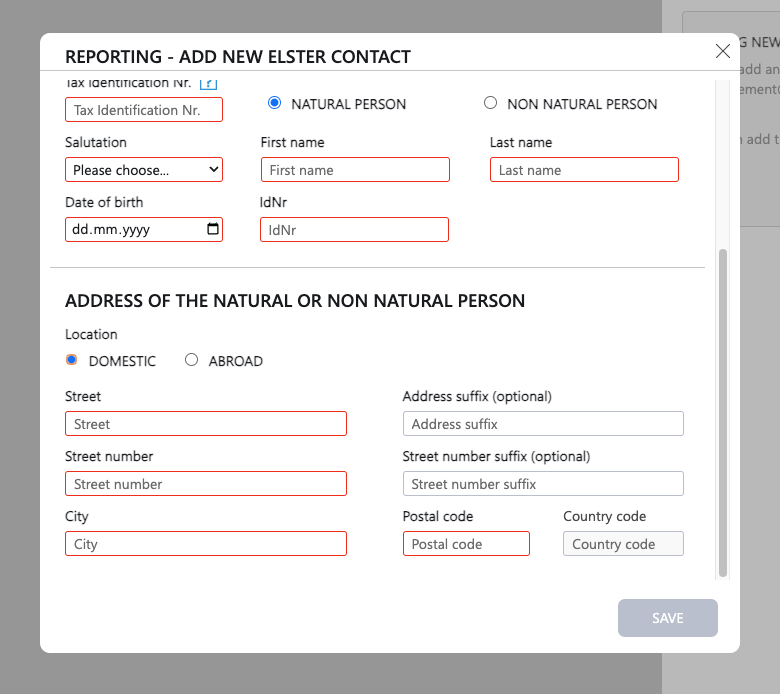

Next, click the button "Enter elster contacts"

-

Fill out the form and click "Save"

tipIn the language field you may select the language in which the new contact should receive emails in the future. Fields such as address suffix or street number suffix are optional.

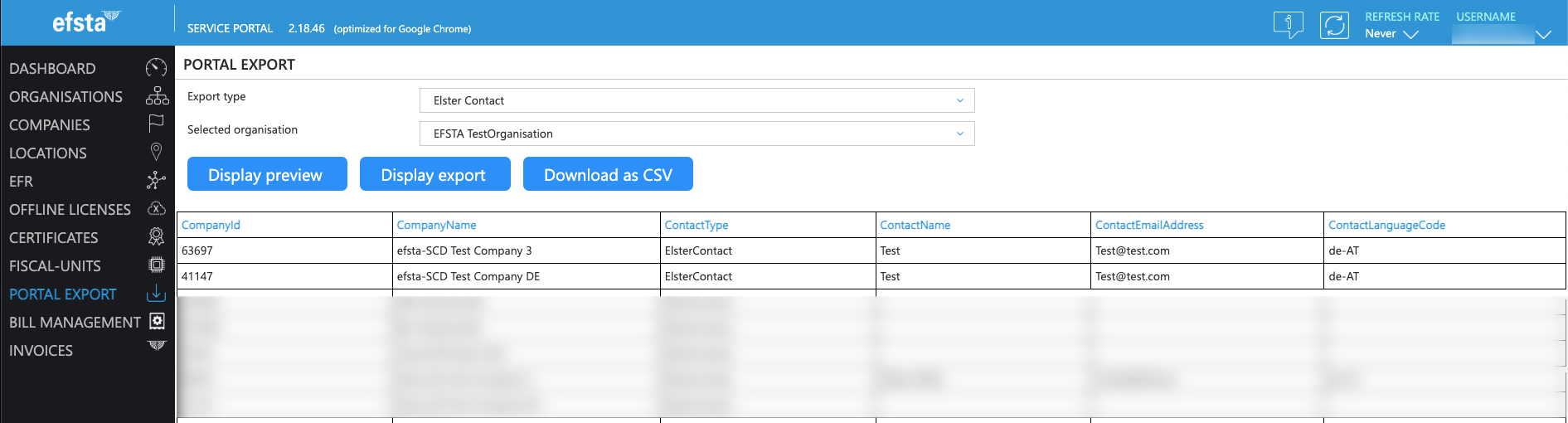

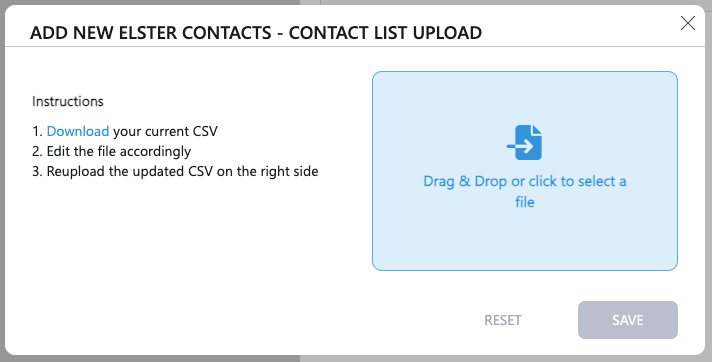

Management on Organisational Level

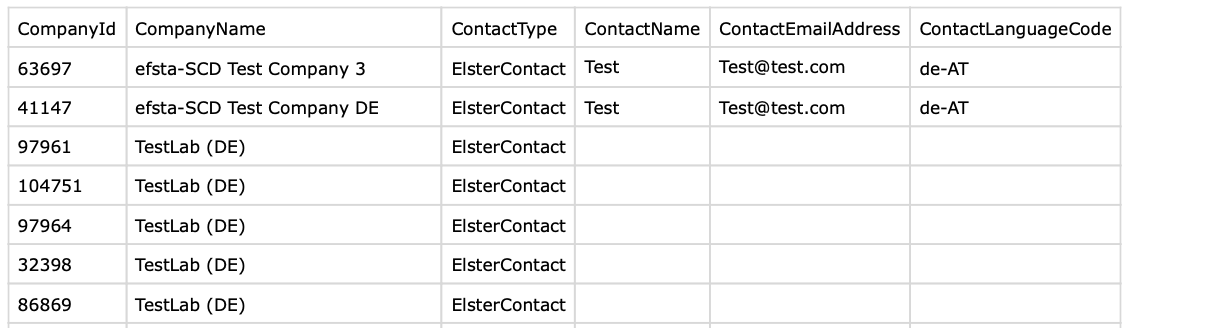

At organization level, you may view and adjust the Elster contacts of all subordinate companies at once by editing the corresponding CSV file.

First, download the current file:

- Navigate to "Portal Export" on the left-side navigation

- Select the export type “Elster Contact"

- Choose the appropriate organisation

- Click the button "Download as CSV"

Now, open the CSV with an appropriate program and add data to the columns "ContactEmailAddress" and "Contact/Name" (separated in the CSV using “;”). Please note that for German-language notification emails, de-AT must be entered in the ContactLanguageCode. If you want the notification in English, enter en-US!

The completed CSV file must then be uploaded to the efsta Portal:

- Navigate to "Organisations" on the left-side navigation

- Select the organisation name or click the symbol with the three dots on the right side of the appropriate organisation

- Proceed by navigating to "Elster Report"

- Next, click the button "Enter elster contacts"

- Upload the new CSV file in the drag-and-drop section

- Click "Save"

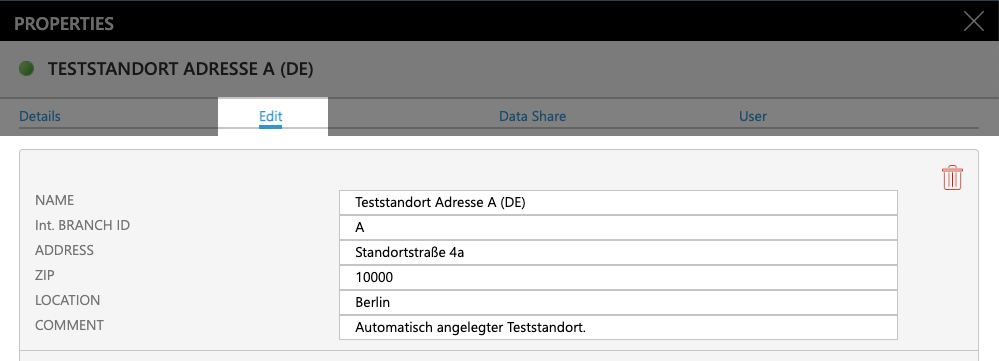

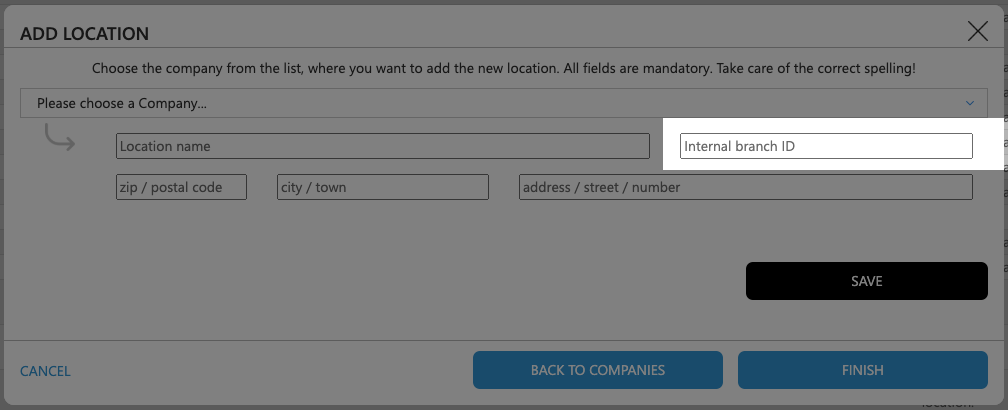

Location Data

The taxpayer's location data must be entered correctly for legally compliant reporting of cash registers in MeinElster.

For both new and existing installations of cash registers, it must be noted and checked in the efsta Portal whether the value "internal branch ID (Int. FILIAL ID)" in the portal matches the TL (Terminal Location) (see Fiscal Requirements KassenSichV) in the efsta EFR.

Checking existing locations

- Navigate to "Locations" on the left-side navigation

- Click the appropriate location name

- In the Properties menu, navigate to "Edit"

- Check the "Int. Branch ID" value

Adding new locations

- Navigate to "Locations" on the left-side navigation

- Click the "ADD" button

- You will find a field for "Internal branch ID" in the overlay

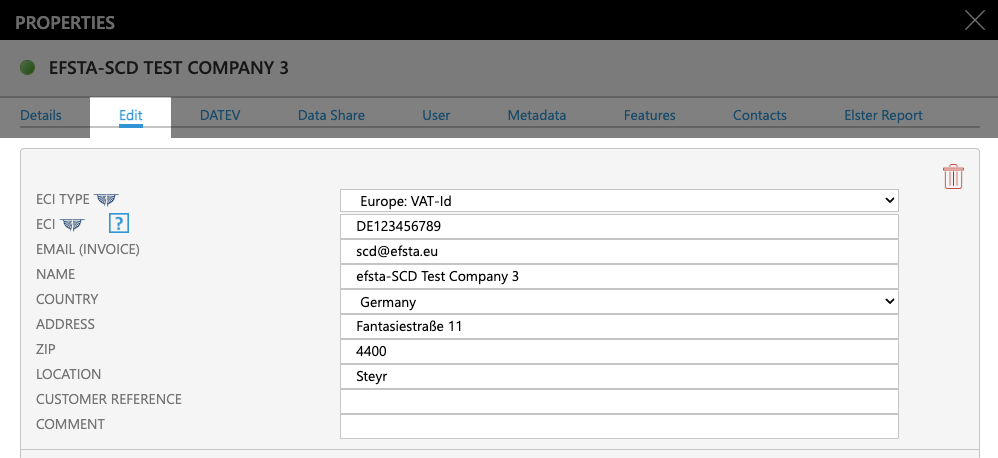

Company Data

Checking and maintaining the company data in the efsta Portal is essential to export data corretly and therefore also fulfill the reporting obligation.

Please check whether all data is complete and either correct or add it if necessary, in particular the following sections:

- Name

- Street

- Zip code

- Town

Checking existing companies

- Navigate to "Companies" on the left-side navigation

- Click the appropriate company name

- In the Properties menu, navigate to "Edit"

- Check the content

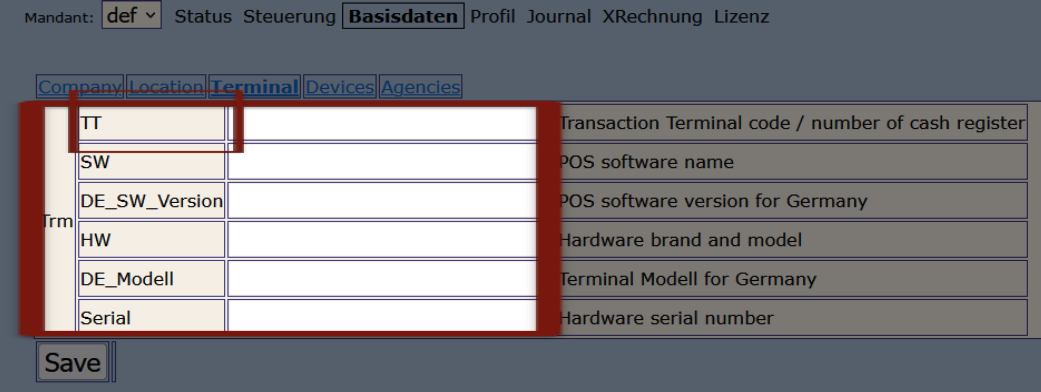

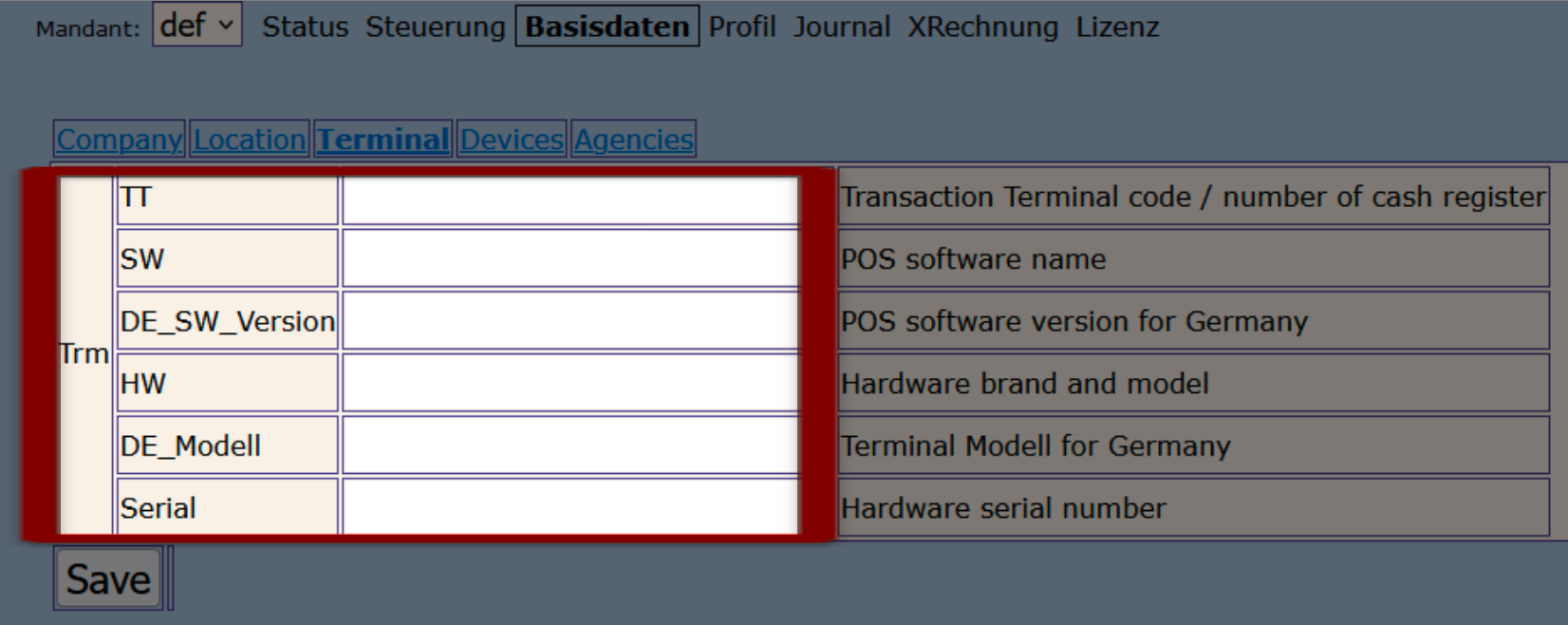

Terminal Data

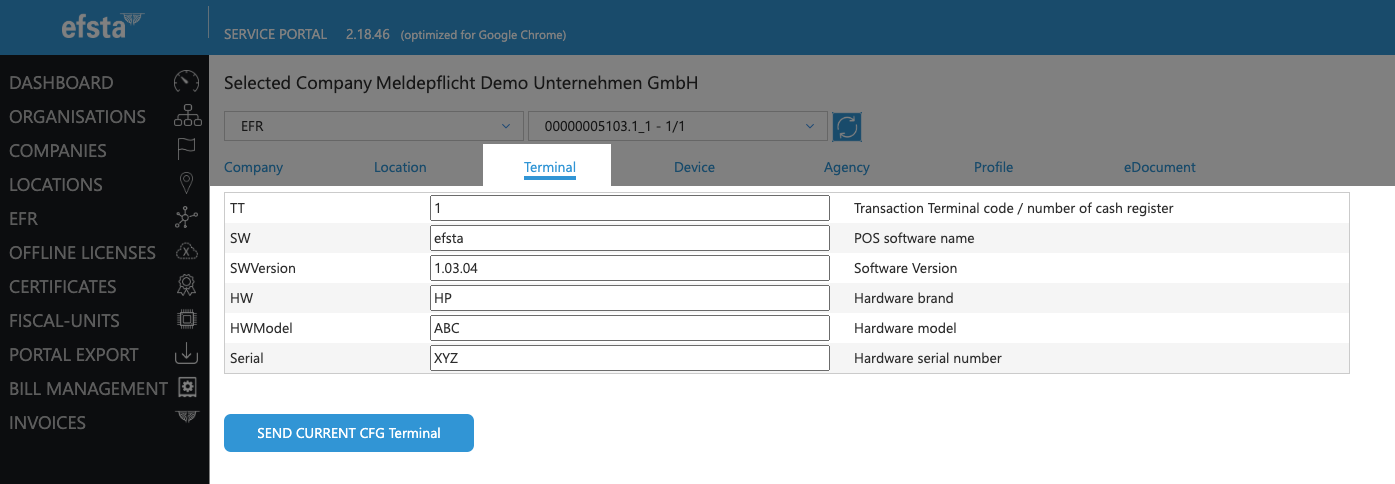

Terminal data (cash register data) must be entered correctly for legally compliant reporting of cash registers in MeinElster.

The following data, which is also used as basis for the DSFinV-K export, must be validated or provided if missing:

- Software

- Serial number

- Manufacturer

- Model

If no serial number has been entered in the portal, the assigned TL/TT is used as the serial number instead.

These data fields can be maintained either via the EFR interface or in the efsta Portal. We recommend using the efsta EFR - maintenance of the terminal data in the efsta Portal is optional. The data fields are transferred to the efsta Portal via the EFR interface as a request, but checking or supplying additional data is still required. (see Export - Set Sales Header)

With the latest change to the reporting obligation rules by the BMF, the software version (DE_SW_Verison) is no longer a mandatory field.

Maintenance in the efsta Portal (Optional)

- Navigate to "EFR" on the left-side menu

- Click on the Cloud symbol of the appropriate EFR

- Click on "Terminal"

Data Validation

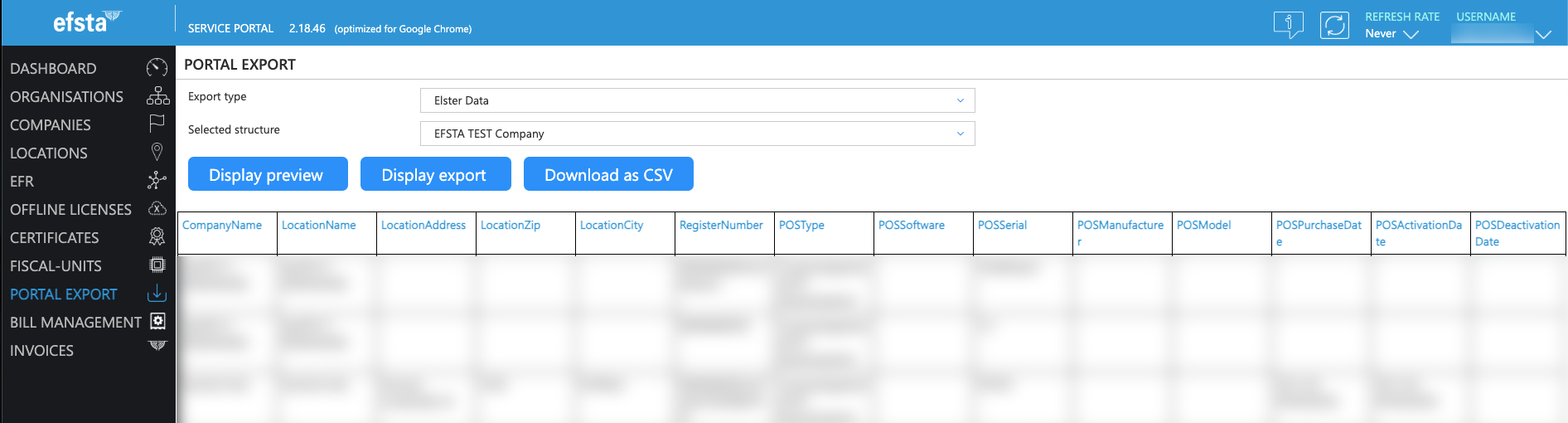

You can initiate a download to get an overview of all the reporting data entered. Please mind that this data export is for validation purposes only, as it is not possible to upload processed data in the Portal (alternative: API call).

- Navigate to "Portal Export" on the left-side navigation

- Select the export type “Elster Data”

- Choose the appropriate organisation

- Click the button "Download as CSV"

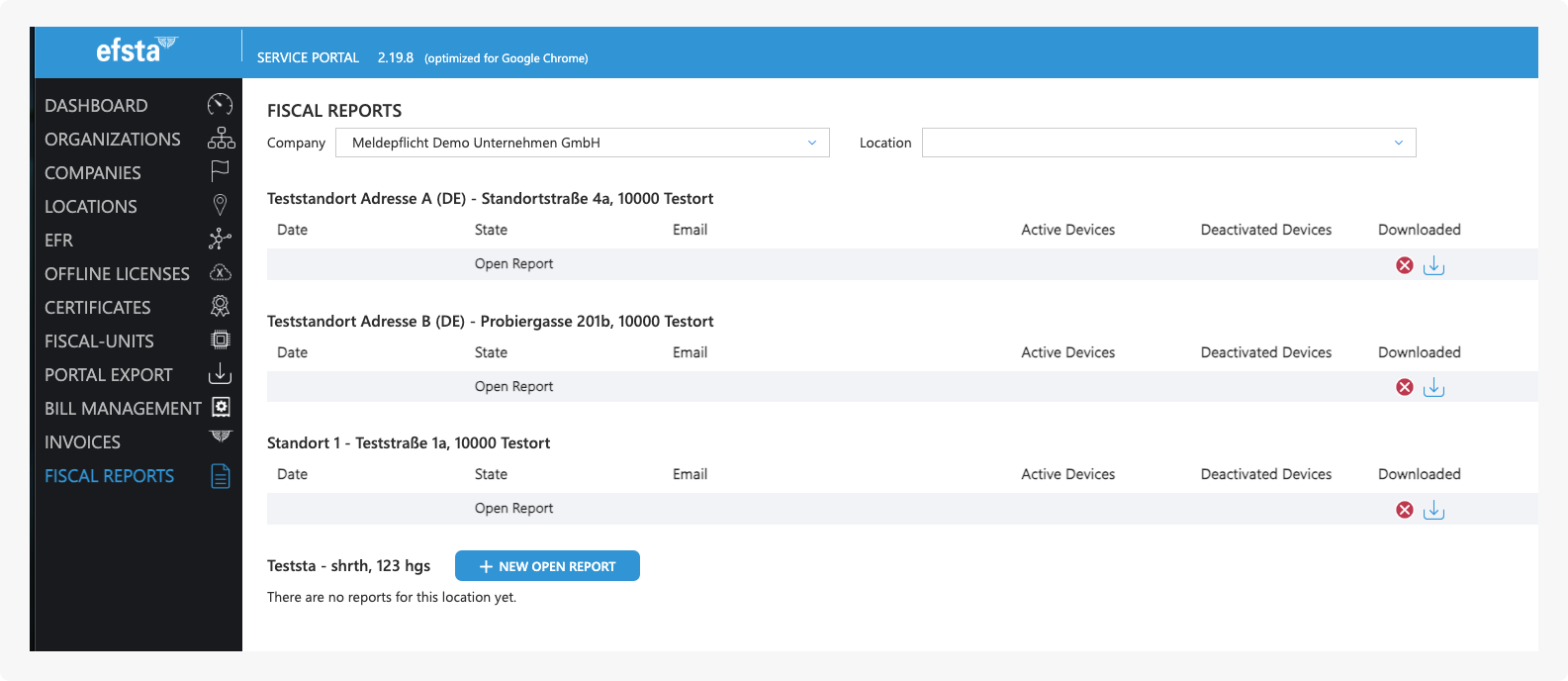

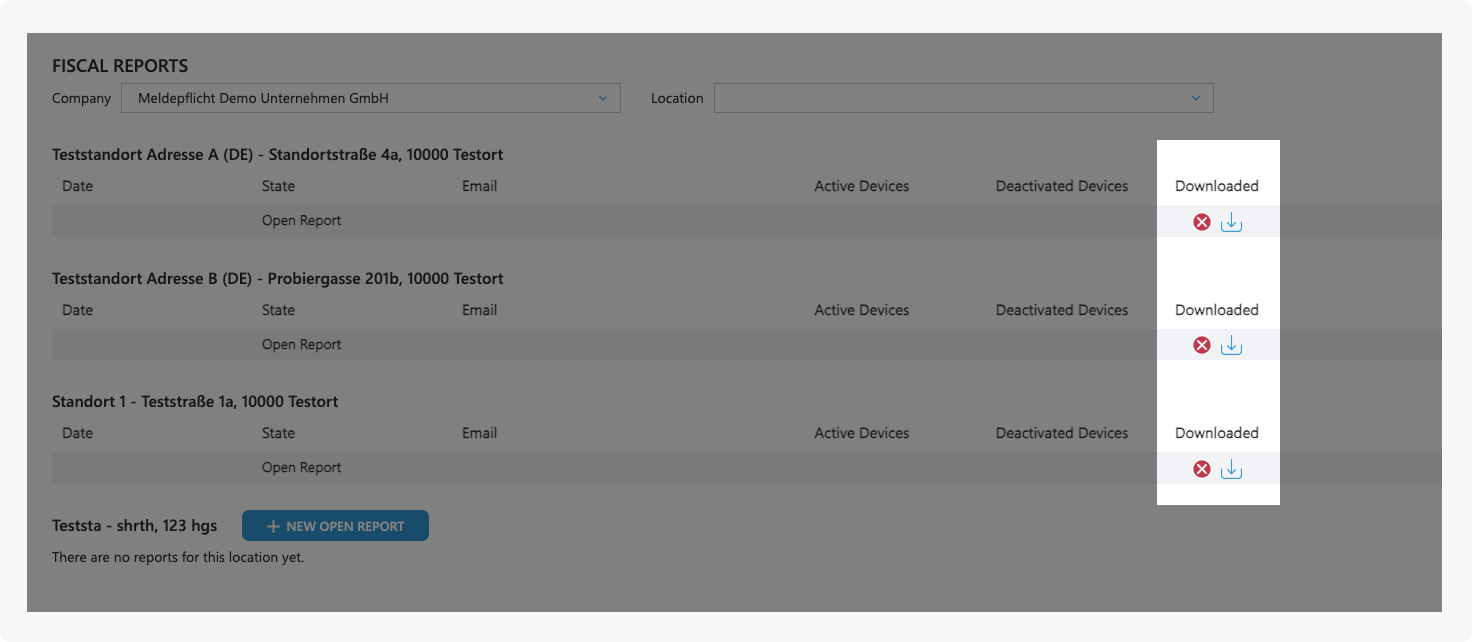

Fiscal Reports

Report Overview

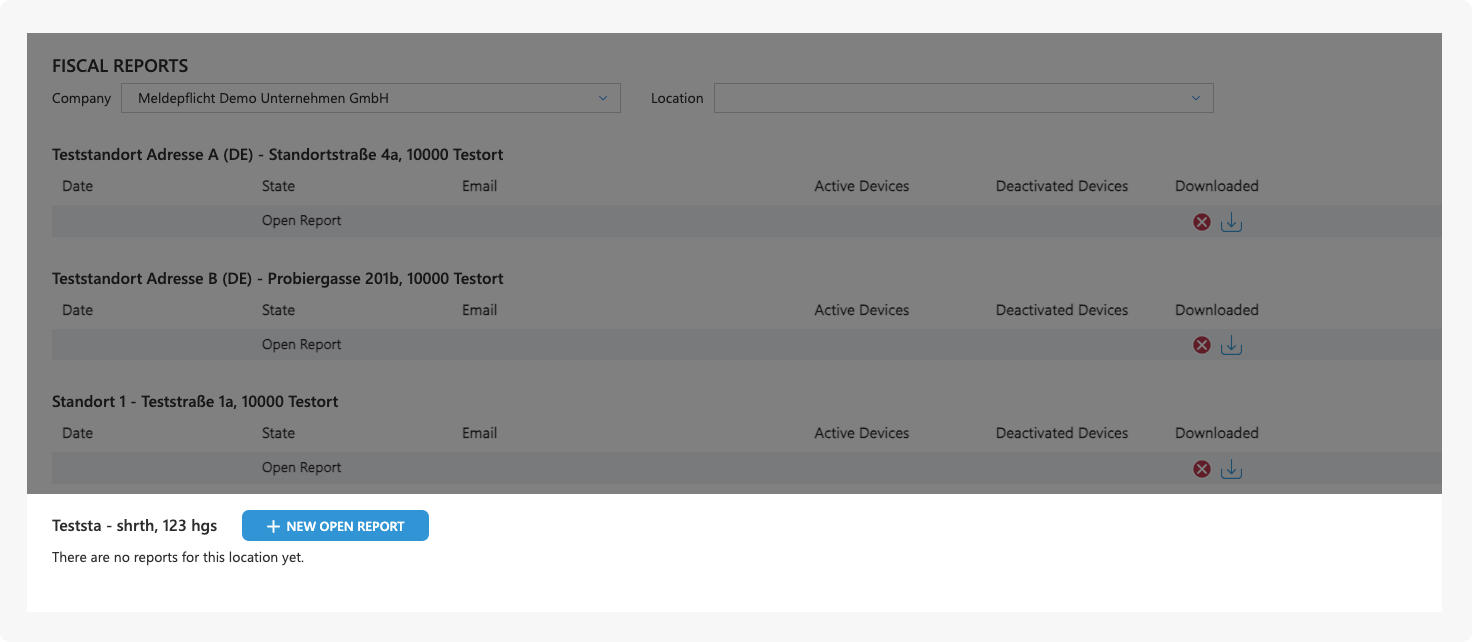

- Navigate to "Fiscal Reports" on the left side of the portal

- Select a company from the drop down

You will now see an overview of all the completed and open reports for this company. At the section "Downloaded" you can view the status of said report and whether it was already processed by an employee. If the report was not downloaded yet, it may still contain issues or missing data which has to be resolved before creating the updated file. By clicking the blue download button, you will access the detail page of the open report.

If you want to make changes manually and there currently is no open report, you can click on the button "New Open Report" which will create a file that can be edited as usual.

Editing Open Reports

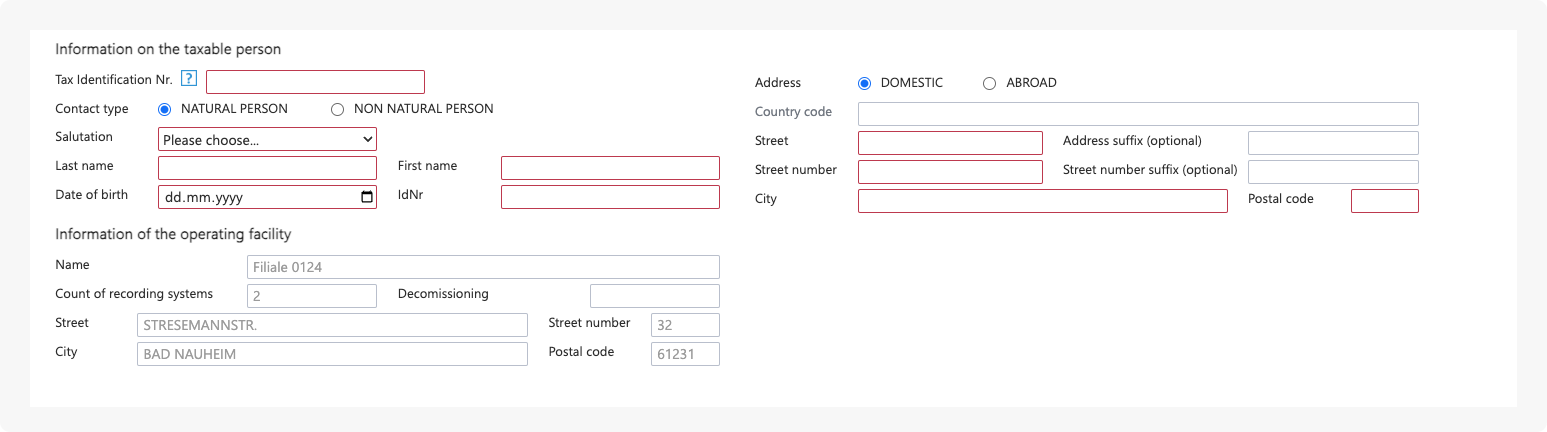

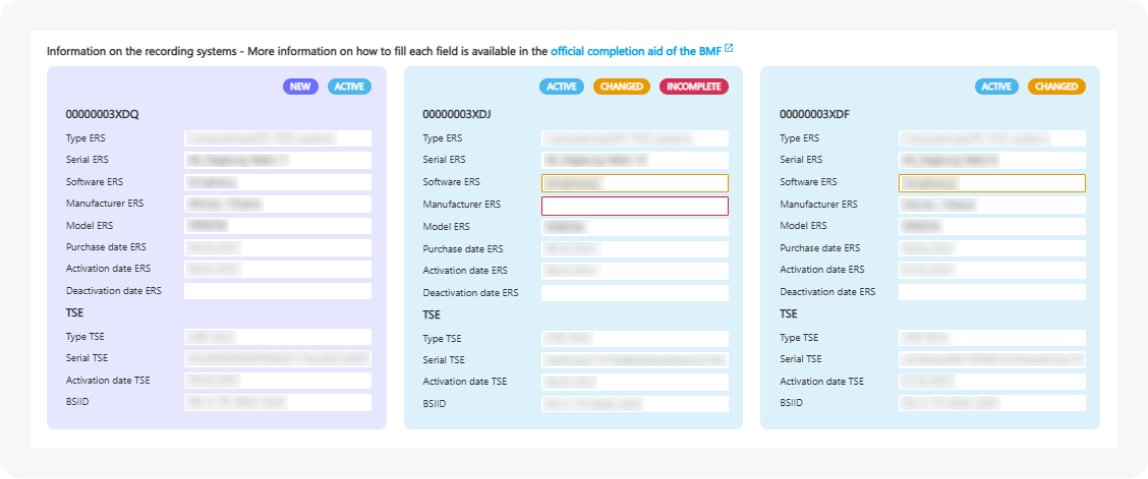

The TSE data is automatically transferred from the efsta EFR and subsequently used for reporting.

If information is missing and the reporting obligation cannot be fulfilled, the corresponding fields will be highlighted with a red frame. Please complete all of these marked fields in order to create an XML file with correct content!

When changing existing content on this page, any differences to the previous report are shown in orange and will be transferred to the efsta Portal, as well as the EFR as soon as the changes are saved.

Furthermore, all registers will be marked with various tags at the top and different background coloration, like for active-, new-, deactivated-, or test-registers.

If you are unsure what to add to an incomplete field, you can use the official completion aid of the BMF.

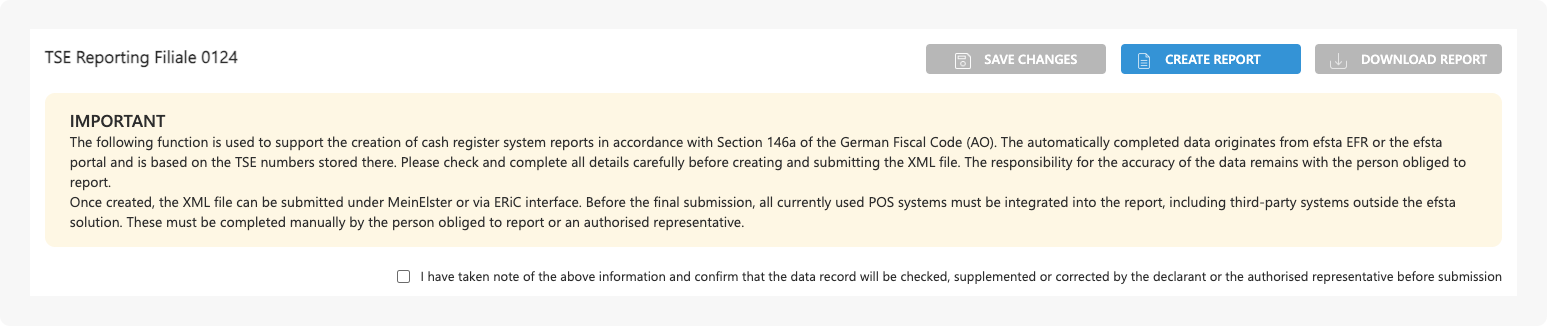

While working on the data, you can save at any time with the "Save Changes" button.

Once the report for the upcoming notification was completed, the disclaimer at the top must be approved via checkbox. If the disclaimer was not previously accepted, a notification window will be displayed when trying to close the report.

By clicking the button "Create Report" the file will be closed and editing capabilities disabled. If this was done too early, a new report can be opened on the report overview page. Once saved, the XML file can be downloaded locally using the "Download Report" button. Afterwards, the file only has to be uploaded to MeinElster.

Enduser Instructions

Here you can find a guide specifically for endusers to properly set up their weekly notifications, edit and download cash register information and processing the data in MeinElster, available in english or german.