Frequently Asked Questions

General

What type of fiscalization is there in Italy and how can I comply with Italian tax law?

In Italy, one hardware element is required for tax compliance: the RT printer. Every POS or PMS system in Italy must be able to fiscalize with an RT printer. The hardware must be certified and registered with the Italian tax authority - Agenzia delle Entrate. In Italy, all merchants are obliged to electronically store and transmit daily receipts (Z-Report or EOD Report) - this is prescribed by Legislative Decree no. 119/2018.

How can I ensure full compliance with tax regulations in Italy?

First and foremost by complying with the regulation that requires an RT device. In addition, the integration of efsta Middleware into your systems in Italy ensures full compliance with Italian tax law.

How can I be protected from tax audits in Italy?

By integrating efsta's fiscal middleware into your payment systems, you will be safe from tax audits. Through our portal, you can easily obtain the fiscal exports you need in case of an audit. In Italy, it is essential to keep all invoices and tax documents during a tax audit to ensure compliance and prove the accuracy of the tax returns submitted. efsta offers tax export as an integrated service with the tax middleware.

What is the "Lotteria degli Scontrini" and is it compulsory in Italy?

The Lotteria degli Scontrini is an Italian government initiative designed to encourage consumers to request receipts for their purchases in order to promote the use of traceable payments and combat tax evasion. Under this program, consumers can participate in a lottery by registering the electronic receipt they receive after their purchases. While merchants are required to issue receipts for transactions, participation in the lottery is completely voluntary for consumers. The program is part of Italy's broader efforts to improve transparency and tax compliance, but consumers are not required to participate in the lottery itself.

How does the lottery work?

There are two different types of lotteries in Italy.

The instant lottery and the delayed lottery

Instant lottery

With the instant lottery, the printer automatically prints a lottery data matrix on the ticket if the payment is more than €1 and is made exclusively electronically.

The result of the prize is displayed immediately, so the customer knows straight away whether they have won.

For this to work, the printer must download lottery codes from the Agenzia delle Entrate.

Delayed lottery

The customer registers to participate in the lottery game by entering a lottery code released by the lottery web portal.

The company name of the location where the printer is installed must be specified when the lottery voucher is sent to the tax office.

The printer collects the requests for participation in a special memory, after 100 requests and a Z-report the requests are sent to the lottery server.

To add a customer's lottery code to a request, the field ESR.Ctm.IT_CodiceLotteria is used:

<Tra>

<ESR>

<Ctm IT_CodiceLotteria=“ABCDEFGH” />

The background to this is that the tax authorities know whether the receipt is being used - instead of the on-site check in the store or the obligatory registration like in Austria.

How can I fiscalize both B2B and B2C transactions from a single POS?

To comply with fiscalization regulations, you can integrate the efsta Middleware - Italy Solution. With our fiscal middleware, you are able to meet the fiscalization obligations for B2B and B2C transactions.

How can I create a daily closing?

A daily closing is mandatory (Z-report) as the printer will block sales if a Z-report is not sent within 48 hours. This Z-report can be sent from the upstream system or from the EFR.

From the EFR

If Fiscal_Z is entered in the attributes of the EFR profile page, a daily Z-report is automatically made by the EFR.

From POS

By sending a non-fiscally signed transaction:

<Tra>

<ESR TL="01" TT="1" TN="1234" NFS="Z"/>

</Tra>

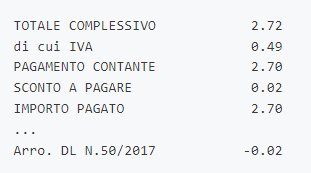

How does rounding work?

Since no 1 or 2 cents exist in Italy, special roundings have been made.

As the three systems communicate with each other (cash register, EFR and fiscal printer), all three can carry out the rounding.

For EFR implementation, efsta recommends sending the rounded amounts to the EFR or letting the EFR do the rounding, as the printer has the worst rounding method of all three systems.

Items and amounts may not be rounded, only payments.

Rounding with the cash register

The rounded amount must be printed in the footer of the receipt.

Rounding EFR

Automatic EFR rounding can be activated with the Fiscal_Rounding attribute. If this is activated, the EFR automatically inserts additional rounding and the corresponding footer text.

Automatic rounding of the printer

Setting automatic rounding on the printer is not recommended due to issues related to refunds.

Ask your tax advisor which option to select. Please note that only cash payments must be rounded! Only round in the Pay element. Split payments or payments with e.g. credit cards must be exact.

The automatic rounding behavior of the printer can be set to:

0 - Rounding disabled (printer default setting)

1 - Full rounding

2 - Round down only

3 - Round up only

Printout on the receipt

Printers

How do I buy a printer?

At the moment, efsta supports fiscal printers from EPSON (FP-90lll & FP-81ll) and Custom. These printers can only be purchased with an Italian VAT ID from an EPSON or Custom partner. Delivered with UID configured by the company as standard. Maintenance contract annual inspection.

- efsta places an order for a printer*

- A technician programs the printer based on the order data and contacts the customer for confirmation*

- The printer is reported online to the tax authorities*

- Client contacts their business advisor/tax consultant to request the QR code

- The business consultant/tax advisor generates the QR code from the printer's serial number

- The printer is ready for delivery*

* if ordered via the efsta Portal

If the printer is purchased via the partner himself, the above steps marked with “*” must be carried out by himself or by a tax consultant

How can I configure printers?

EFR supports fiscal printing with EPSON FP-90III or FP-81II in serial Ethernet or USB mode. The printer is connected via a supplied RS232 cable, an Ethernet cable or a USB mini-B cable.

Connect a keyboard to the printer's USB-A port and follow the steps below to configure the printer:

RS232 connection

- When STATO REGISTRAZIONE is displayed, enter : 3333 followed by the

<CHIAVE>or<C>key. - For SCELTA FUNZIONE enter 17

- Change to COMPUTER with the

<x>key on the numeric keypad - Confirm the selection with

<CONTANTE>or<ENTER> - Note the configured CONSTRUCTION RATE or change it to the desired value

- Use

<CONTANTE>or<ENTER>to go to CONTROLLO RTS/CTS - Change to 0 using the

<x>button - Confirm with

<CONTANTE>or<ENTER>. - Exit with

<CHIAVE>or<C>

Ethernet connection

- If STATO REGISTRAZIONE is displayed, enter : 3333, followed by the

<CHIAVE>or<C>button - For SCELTA FUNZIONE, enter 19

- Switch to COMPUTER with the

<x>key on the numeric keypad - Confirm the selection with

<CONTANTE>or<ENTER> - Print all ETH settings with

<SUBTOTAL>or<+>on the numeric keypad - Exit with

<CHIAVE>or<C>

USB connection

- When STATO REGISTRAZIONE is displayed, enter 3333 followed by the

<CHIAVE>key o

Is it mandatory to connect a payment terminal to the RT Printer?

The 2025 Budget Law tasked the Italian Revenue Agency (AdE) with defining a regulation to link fiscal printers (RT) with payment terminals, allowing electronic payments to be properly tracked.

On October 31, 2025, AdE published the official provision, available here: AdE – New rules effective from Jan 1, 2026

The regulation introduces a logical association* between each RT and its corresponding payment terminal. This association must be made by the merchant (or their tax advisor) directly through the Cassetto Fiscale, where AdE provides a dedicated function for linking registered RTs and terminals.

This function will be made available in the beginning of March 2026. Starting from the general availability of this function, merchants will have 45 days to register payment terminals already in use. From that point on, any new terminal must be registered within the 6th day of the second month after the payment terminal has entered service. Currently, no APIs or external interfaces are available to perform this operation from systems such as the EFR.