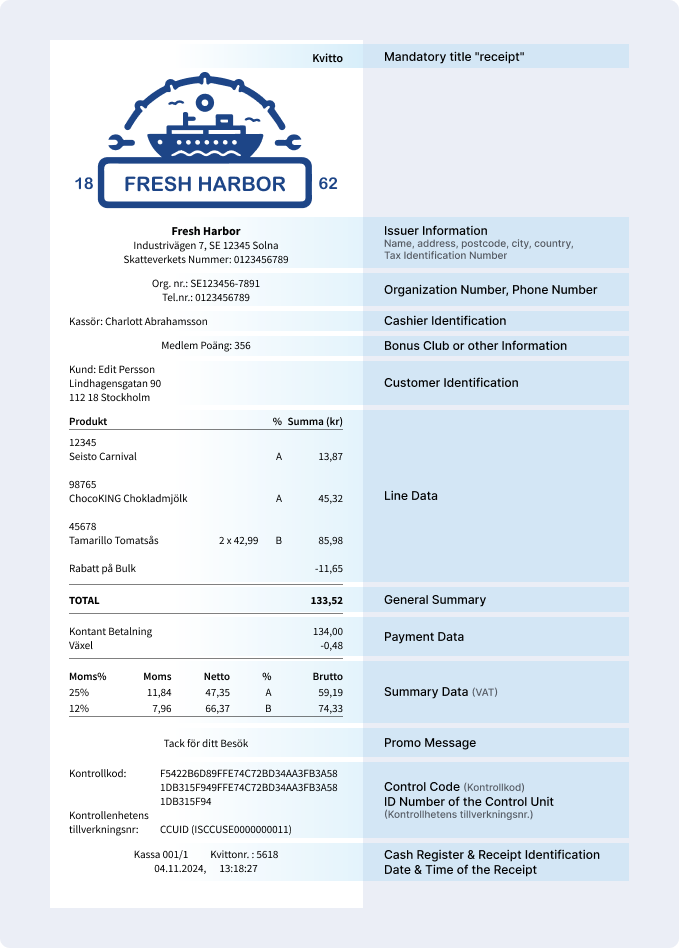

Receipt Layout

Layout

A cash receipt must at least contain the following information:

- Company name and organization number or social security number

- The address where the sales take place

- Date and time for the sale

- Serial number of the receipt from an uninterrupted ascending number series

- ID number of the cash register

- Item name and quantity of sold items

- Name of services and quantity of sold services

- Sale amount of the goods or services including VAT and total sale amount for the customer to pay

- The VAT due on the amount of the sale (VAT in total)

- The breakdown of the VAT on different tax rates

- Means of payment (as payment with cash, debit or credit card, other electronic payment service, gift voucher, coupon etc.)

- The manufacturing/serial number of the control unit

- The information “electronic cash receipt” if the cash receipt is provided in electronic form

Good to know

In addition, we strongly recommend that the control code will be printed on the receipt as well.

Example Response

All Fis.Tag elements in the response must be printed on the receipt.

XML Response

<TraC SQ="2510">

<Result RC="OK"/>

<Fis>

<Tag Label="Kvittonr" Value="810" Name="FN"/>

<Tag Label="Kontrollkod" Value="T22UQ2YLQGFR5D4XQFY5AUM5JICPFDC4;6JTEIAIRBOCE3SUOJ4FZT63JVM" Name="Fiscal"/>

<Tag Label="Kontrollenhetens tillverkningsnummer" Value="ISCCUVERIFIKATION" Name="SignDevId"/>

<Tag Label="Org. nr" Value="373737-3737" Name="OrgNr"/>

<Tag Label="Kassa" Value="EF15KJTK11033101" Name="RegisterId"/>

<Tag Label="" Value="*** TEST ***" Name="Info"/>

</Fis>

</TraC>