EFR Architecture

Introduction

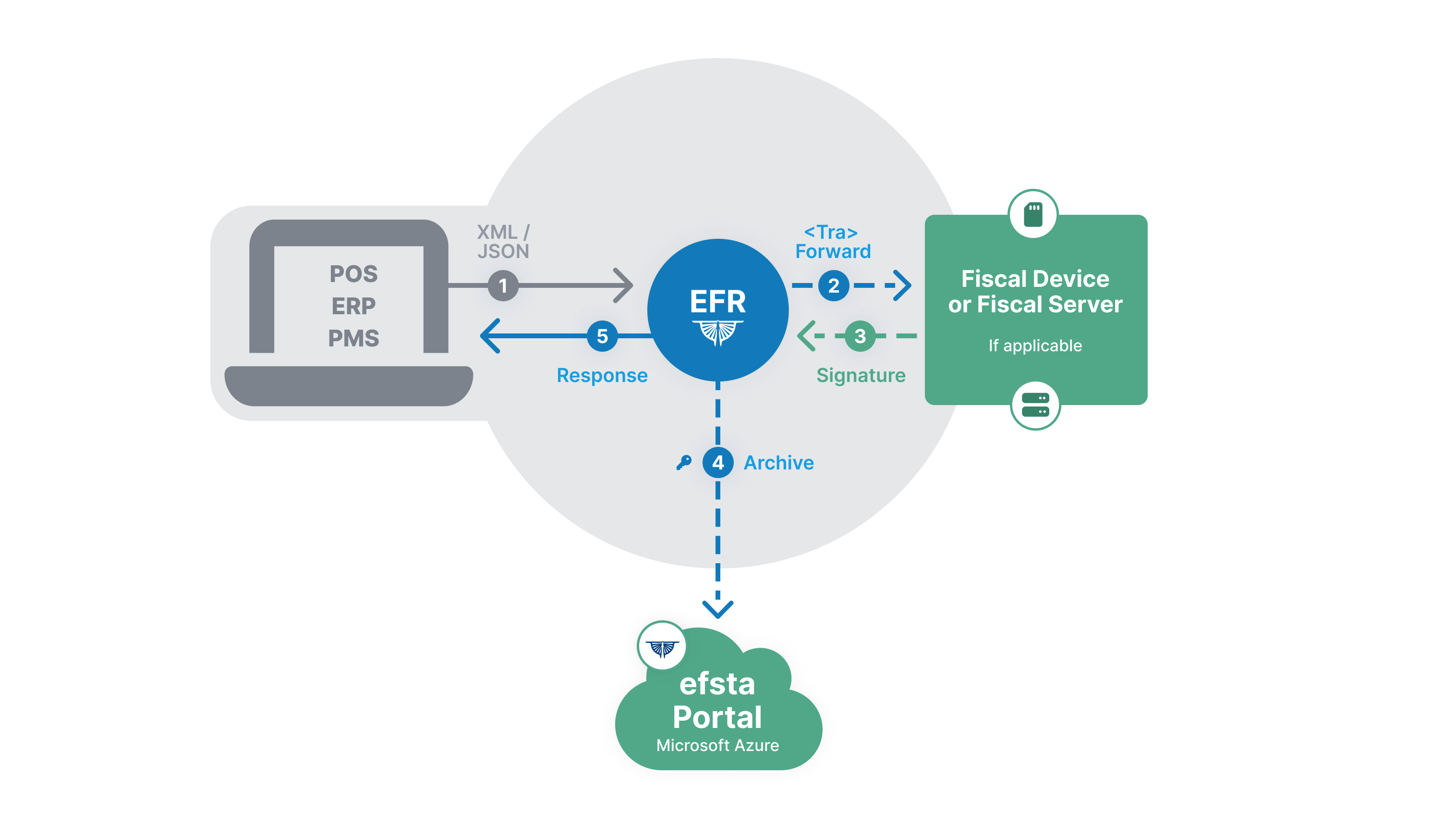

The efsta middleware electronic fiscal register (EFR) is a software to fulfill the country specific requirements for fiscalization. The software receives (transaction) data via REST interface from any upstreaming system (POS, ERP, PMS). As those upstreaming systems have various architectures, EFR can be adjusted to the customer-specific architecture. After receiving a transaction, it gets forwarded to a fiscal device – in those countries where it is required – or processed internally. efsta also provides a cloud archive – called efsta Cloud – where the fiscalized data gets stored encrypted after the fiscalization process is done.

Architectures

Local installation

localhost:5618/register

For “classical” local installations EFR can be installed locally. By using this EFR architecture there is a 1:1 communication between upstreaming software and EFR. EFR creates a main client which stores all data to provide it for the exports. In case of an outage, it will affect both systems at the same time (for example hard disc crashes,…). This architecture is recommended for countries with fiscal hardware devices like fiscal printers, hardware signature sources. To use this architecture, connect EFR with the efsta cloud by using the Badge (unique identifier of a company establish cloud communication to the efsta cloud for using the monitoring and the archive) of the company level, provided in the efsta portal.

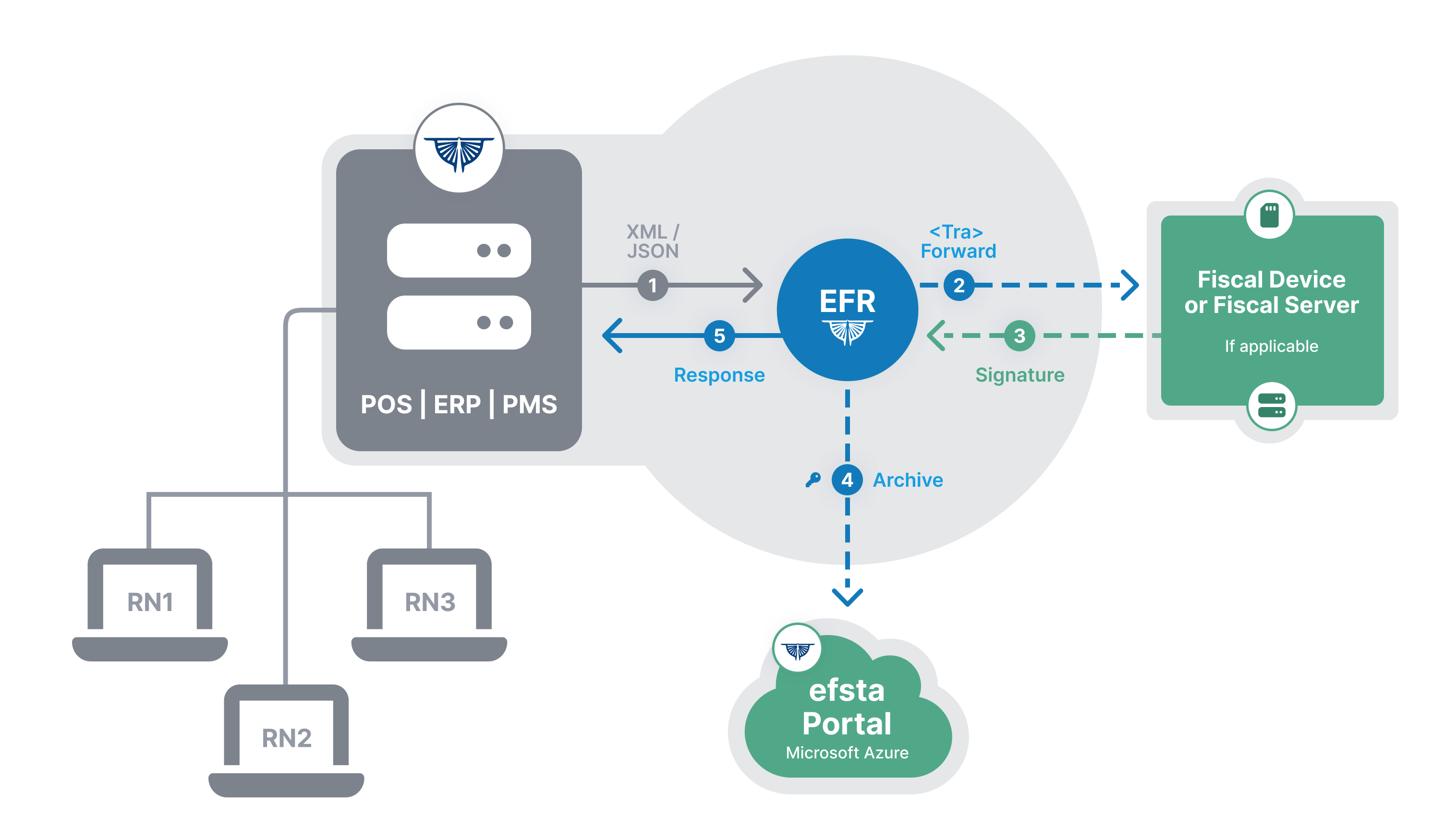

Local Server Installation

[local IP]:5618/register

In case of stores that have many upstreaming systems within one store and want to centralize fiscalization on a centralized server, EFR can be installed on a store server. One EFR then handles all transactions from that legal entity (tax payer). As each upstreaming system identifies with its own IDs (Location ID and Terminal ID) data will be stored and generated in the right export/journal. This will be shown in the EFR, as sub clients will be created for each new combination of the mentioned IDs. The partner is responsible to enable (network) communication between the systems and to protect the system(s). Recommended signature sources are cloud signature devices or other servers for signing the fiscal data. Fiscal hardware devices are not recommended for such an architecture.

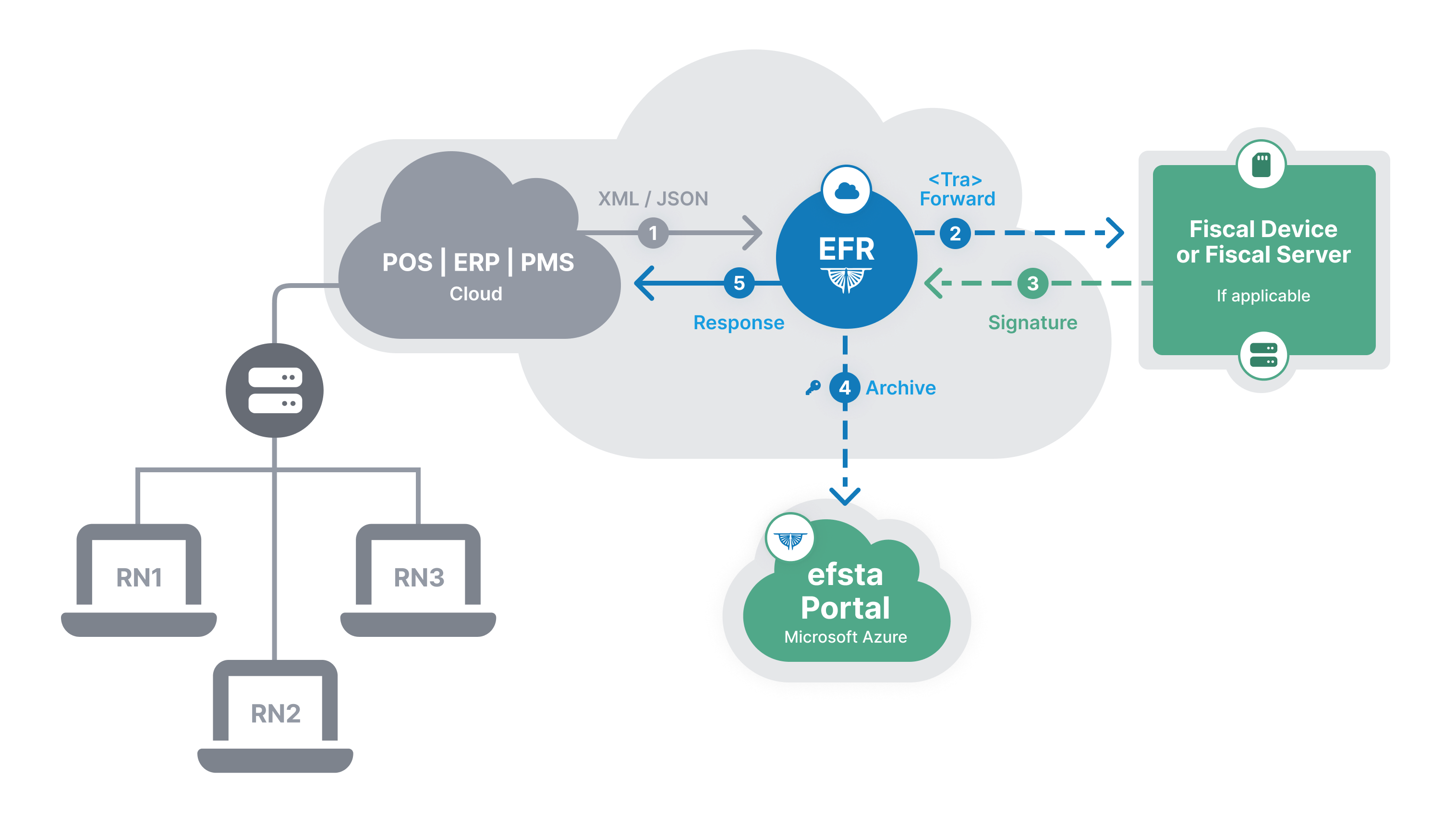

Provider Cloud Installation

[public IP]:5618/register

Cloud upstreaming systems can use EFR hosted in the cloud. This can be any cloud for example Microsoft Azure, AWS Cloud or any other cloud. As the cloud is provided/hosted by the partner the security –, updating –, Network –, Firewall–,… -topics in the partner’s responsibility. As cloud systems are centralized systems that handle different taxpayers on one installation, each transaction has an additional identifier which is the tax ID/VAT ID or Steuernummer or GLN. Each upstreaming system then gets a new client within EFR to provide the client-specific exports. The clients will then be identified with the combination of TaxId, TL and TT (Vat ID, location ID and till ID). Each client needs to have the adequate signature source in countries where it is mandatory.

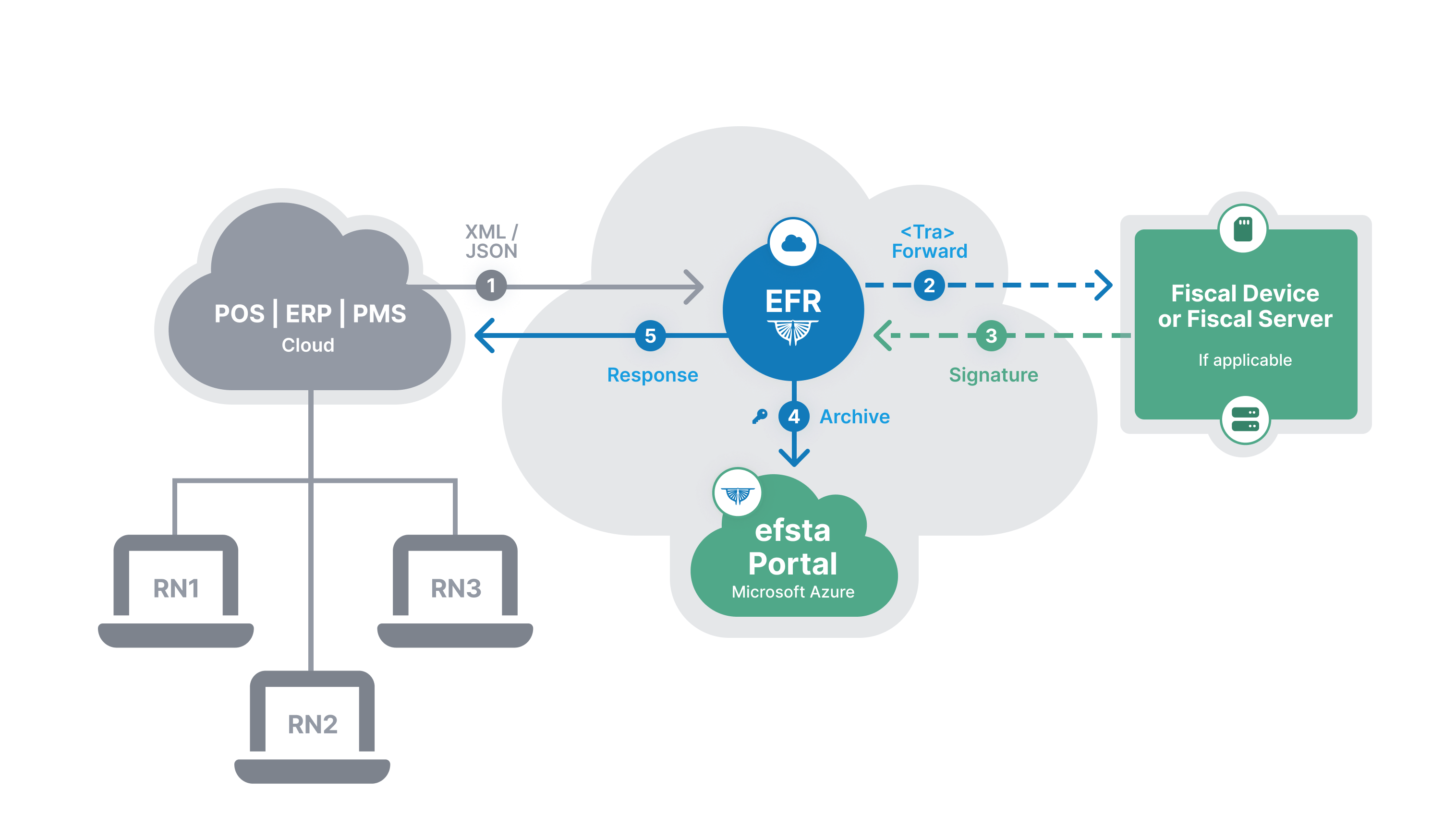

efsta Cloud Installation

efsta provides a product where EFR is hosted on a cloud maintained by efsta. The functionality is comparable with the “provider Cloud Installation”, the only difference is that efsta hosts the EFR. The partner will then send data to specific endpoints by identifying with API key and API secret to get the OAuth token. This product is exclusively available for upstreaming systems that are fully in the cloud and no fiscal hardware is needed (for example fiscal printers, hardware signature devices,…). There is no user interface for the customers to configure as efsta will provide all settings.

Exports can be downloaded from the efsta Portal or by sending HTTP requests to the cloud EFR.

Product only available on request.