E-Invoicing Poland

The productive system for Poland has not been launched yet, but the test & pre-production environment is available!

Currently, when sending DD="PL", the transaction is routed to the pre-production (demo) environment. In the future, it will use the live system.

If you would like to act as a pilot customer, please contact your partner manager.

After the E-Invoice has been sent, it needs to be approved by KSeF (Krajowy System e-Faktur) before processing can continue. As soon as efsta receives the state of the E-Invoice, it will be updated in the portal, followed by error handling if necessary. The EFR will however respond immediately to the register request.

ESR.DD Fields

In Poland there is no DDto field necessary, so you only have to specify DD in the transaction. Routing E-Invoices happens based on the TaxId.

The invoice status can be requested from us, allowing it to be retrieved within a few minutes.

DD="PL-TEST"- Test environment, which does not require real access credentials and should be used exclusively with anonymized test data.DD="PL-DEMO"- Pre-production (Demo) environment with realistic process flows and actual access credentials. Operates technically like the production system but has no legal effect. Only anonymized test data should be used.DD="PL"- Live environment for processing real E-Invoices. All transactions are legally binding.

Example Request

- JSON

- XML

{"Tra":

{"ESR":

{"D" : "2025-07-17T08:30:15", "DN" : "78312", "TL" : "001", "TT" : "1", "TN" : "1", "T" : "8.38", "Opr" : "101", "OprN" : "Mario Rossi", "OprTIN" : "xxx", "TP" : "Table 1",

"DD" : "PL",

"Ctm" : { "TaxId" : "PL1111111111", "Nam" : "The Sellercompany Incorporated", "Adr" : "1 Main street", "Adr2" : "Suite 123", "Zip" : "00-001", "City" : "Warszawa", "Ctry" : "PL"},

"PosA" : [

{ "_" : "Pos", "PN" : "1", "IN" : "1001", "SKU" : "456487", "Dsc" : "Example Item", "TaxG" : "A", "Amt" : "3.98", "Qty" : "2", "QtyU" : "Pc.", "Pri" : "1.99", "Cat" : "10", "CatN" : "Example Category 10" },

{ "_" : "Pos", "PN" : "2", "IN" : "1020", "SKU" : "654854", "Dsc" : "Example Item", "TaxG" : "B", "Amt" : "1.50", "Cat" : "11", "CatN" : "Example Category 11" },

{ "_" : "Lin", "Dsc" : "Subtotal", "LAmt" : "5.48" },

{ "_" : "Pos", "PN" : "3", "IN" : "1030", "SKU" : "845868", "Dsc" : "Example Item", "TaxG" : "A", "Amt" : "2.90", "Cat" : "12", "CatN" : "Example Category 12"}

],

"PayA" : [

{ "_" : "Pay", "Dsc" : "Example Payment", "PayG" : "cash", "Amt" : "10.00", "D" : "2025-07-17T08:30:15" },

{ "_" : "Pay", "Dsc" : "Example Change", "PayG" : "change", "Amt" : "-1.62", "D" : "2025-07-17T08:30:15" }

],

}

}

}

<Tra>

<ESR D="2025-07-17T08:30:15" DN="78312" TL="001" TT="1" TN="1" T="8.38" Opr="101" OprN="Mario Rossi" OprTIN="xxx" TP="Table 1"

DD="PL">

<Ctm TaxId="PL1111111111" Nam="The Sellercompany Incorporated" Adr="1 Main street" Adr2="Suite 123" Zip="00-001" City="Warszawa" Ctry="PL"/>

<PosA>

<Pos PN="1" IN="1001" SKU="456487" Dsc="Example Item" TaxG="A" Amt="3.98" Qty="2" QtyU="Pc." Pri="1.99" Cat="10" CatN="Example Category 10" />

<Pos PN="2" IN="1020" SKU="654854" Dsc="Example Item" TaxG="B" Amt="1.50" Cat="11" CatN="Example Category 11" />

<Lin Dsc="Subtotal" LAmt="5.48" />

<Pos PN="3" IN="1030" SKU="845868" Dsc="Example Item" TaxG="A" Amt="2.90" Cat="12" CatN="Example Category 12" />

</PosA>

<PayA>

<Pay Dsc="Example Payment" PayG="cash" Amt="10.00" D="2025-07-17T08:30:15" />

<Pay Dsc="Example Change" PayG="change" Amt="-1.62" D="2025-07-17T08:30:15" />

</PayA>

</ESR>

</Tra>

KSeF Portal Login

Demo/Production Environment

To access the Polish National E-Invoice System (KSeF) you must authenticate using one of the following secure methods:

Option A: Qualified Electronic Seal (recommended)

A Qualified Electronic Seal is a digital certificate issued to a company. It proves that electronic documents come from your organization. It is legally valid across the EU and the recommended way for companies to log in to KSeF without using a personal PESEL number.

-

Purchasing

Choose a certified provider, such as Certum or EuroCert, to purchase the electronic seal. -

Installing the certificate

At Certum, it will be saved on a smart card inserted into a reader or in the SimplySign mobile app. You will also receive a signing application (e.g. proCertum). -

Login

To access the KSeF system, choose the appropriate environment:Once the page opens click on "Authenticate in the National System of e-Invoices". Then submit your NIP, click "Next" and choose "Qualified Certificate".

- The system will generate a login request file

- Sign the file using your provider's application with your qualified seal

- Upload the signed file to complete login

Option B: Trusted Profile

A free digital identity issued by the Polish government, only available if you have a PESEL number.

-

Register online

Go to https://pz.gov.pl/pz/register and fill in your details. -

Verify your identity

Visit a Polish embassy or consulate within 14 days of registration. You have to bring your ID (passport or national ID card) to the appointment. After confirmation, your Trusted Profile is active and valid for 3 years. -

ZAW-FA

You must submit a ZAW-FA to the tax office to associate your limited liability company to you. -

Login

To access the KSeF system, choose the appropriate environment:Once the page opens, enter your NIP, click "Next", and select "Trusted Profile" as the login method. Sign in using your Trusted Profile credentials, then click ‘Sign’ to authorize and complete the login process to the portal.

Test Environment

In the KSeF test environment, it is not necessary to use real authentication data. You can simulate the authentication process.

Test Enviornment Process

-

Access the KSeF Test Environment

Go to the KSeF test portal -

Login context

- Click on "Authenticate in the National System of e-Invoices"

- Enter your NIP (Tax Identification Number) & click on "Authenticate"

-

Authentication

- Select "Qualified Certificate" as the authentication method

- You’ll be asked if your certificate is a signature with a NIP or PESEL number.

Select "Yes". - Select "Stamp with NIP" as identifier type and enter the same NIP number used at the beginning

- Click "Authenticate to test application" to finish the process.

KSeF Token

The KSeF Token is a string of alphanumeric characters (excluding punctuation marks), assigned to the taxpayer or authorized entity and their rights.

It can be used to speed up and facilitate the process of logging into KSeF. Instead of authenticating each time, f.e with a qualified signature, you can generate a token and use that for the KSeF API authentication.

Your token authorizes efsta to issue E-Invoices on behalf of your company.

Generate Token

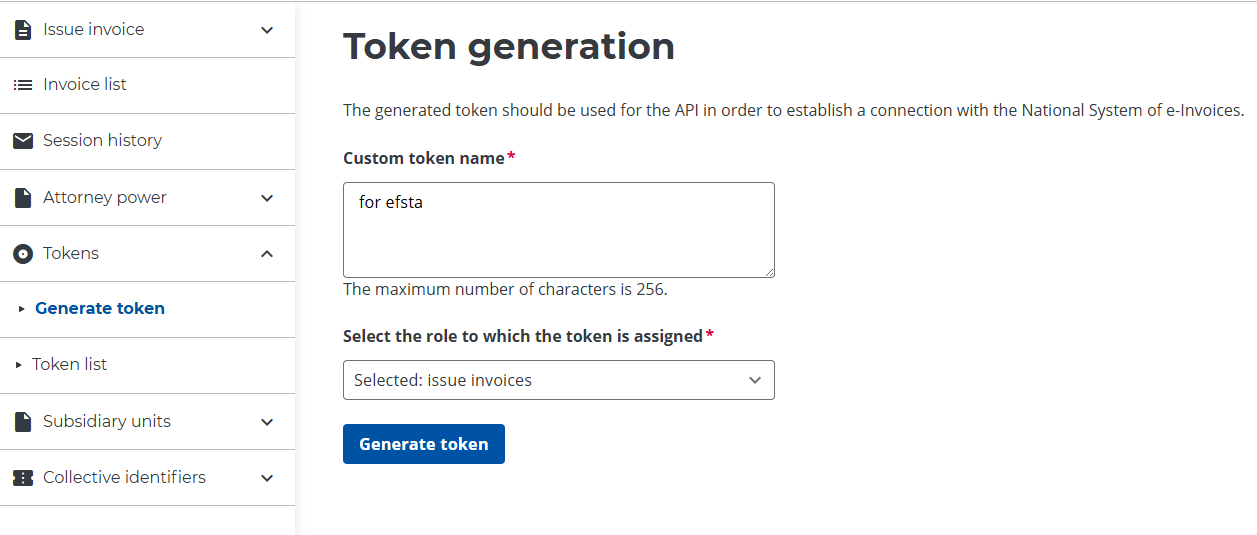

Once you are logged into the KSeF Portal, you will see the main dashboard.

1. Generate a token

Go to the Tokens menu and choose to generate a new token with the role: issue invoices. Once the form has been filled in, click the "Generate Token" button.

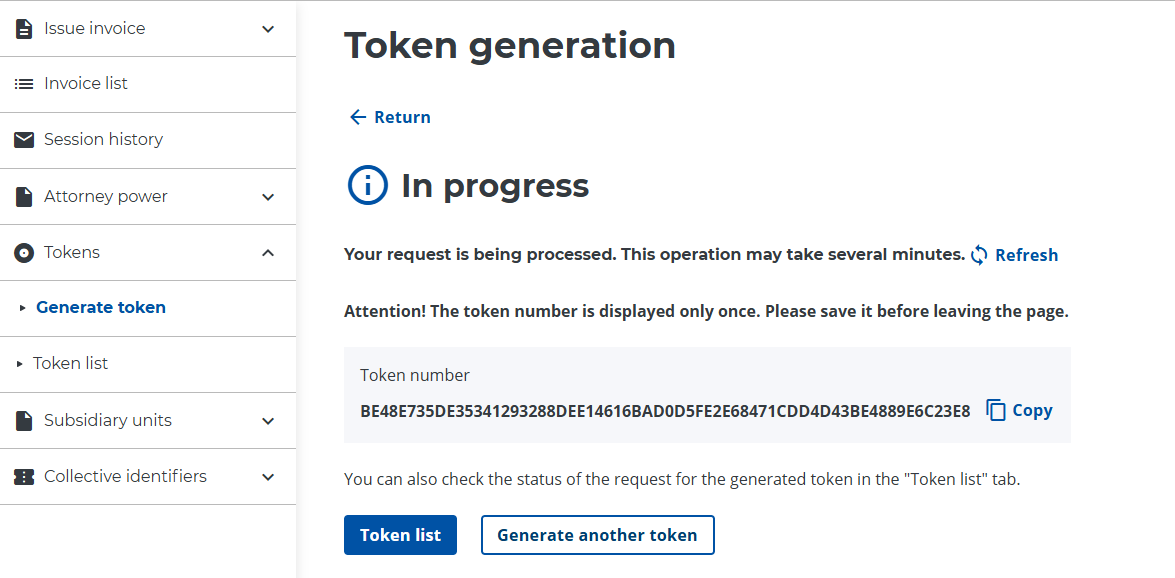

2. Copy the Token

Copy the generated token and paste it into your configuration settings (see following step "Submit Token").

There is no expiration date for the token, so you don't need to renew it.

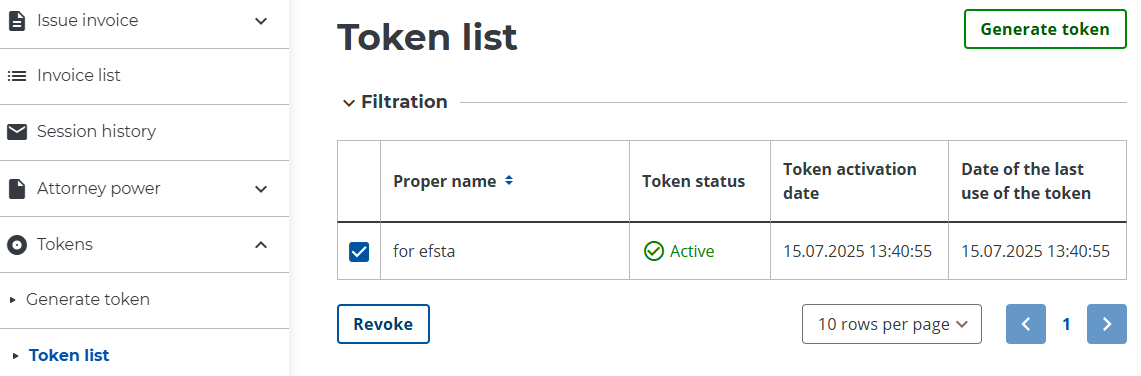

If you want to revoke the token and remove efsta’s access to issue invoices for your company, you can do so in the token list by selecting the appropriate token and clicking "Revoke":

Submit Token

Finally, you have to paste the generated token in your configuration. You can achieve this either using the Portal or the EFR.

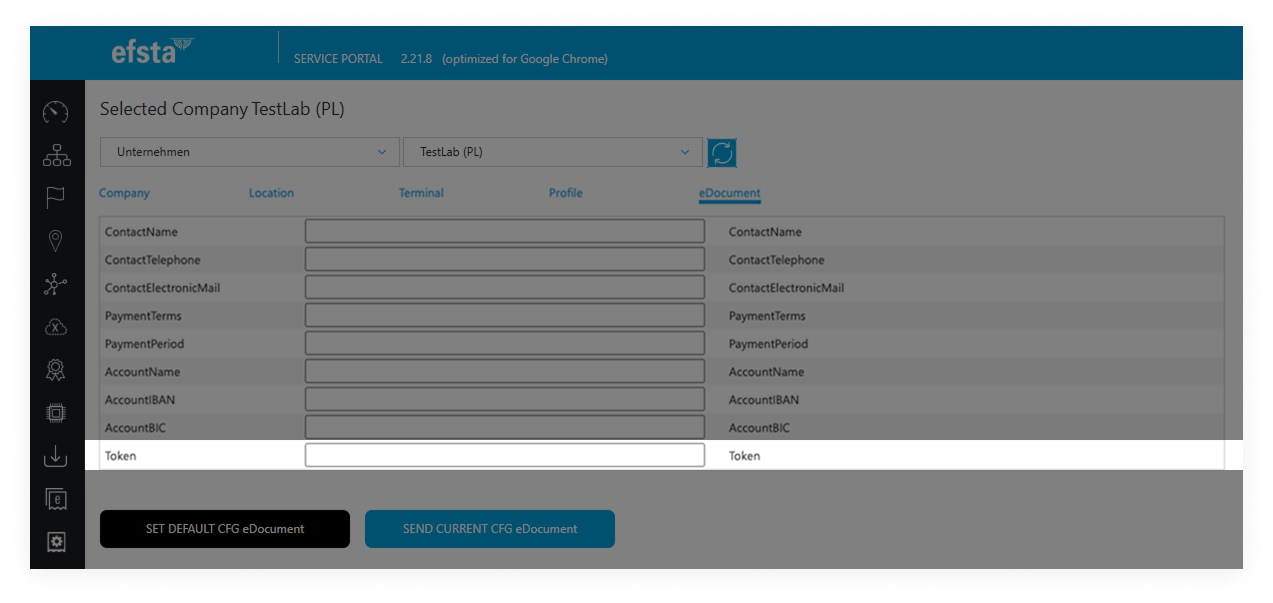

Portal

First, navigate to the appropriate register and click on the cloud icon to change your configuration. Then proceed to the "eDocument" tab and paste your token in the corresponding field.

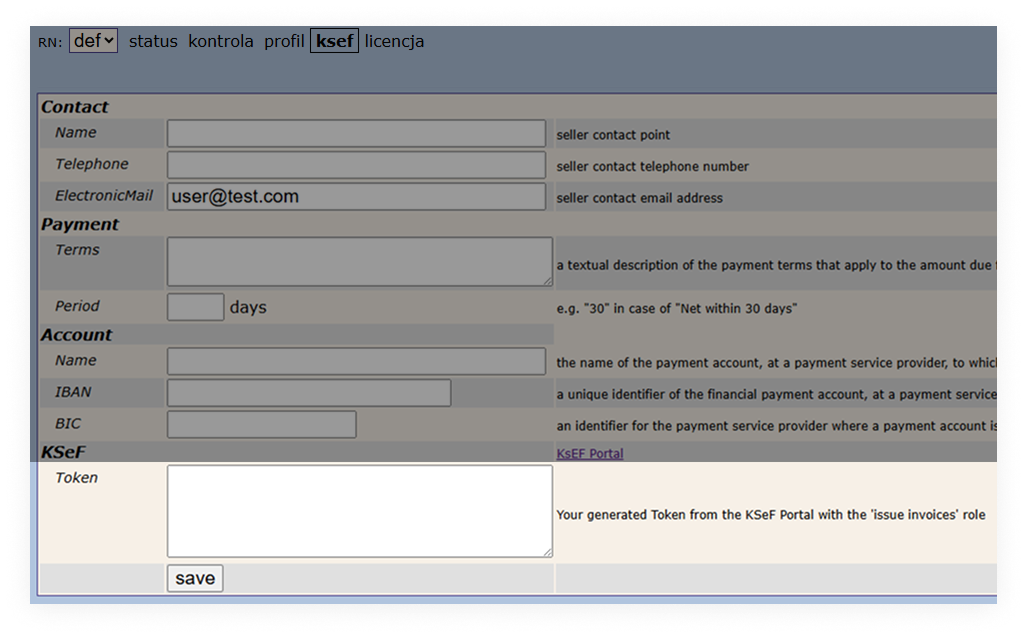

EFR

Open the EFR and navigate to the KSeF tab. In the field "Token" you can paste the needed information.

Once the token is submitted, E-Invoices are limited to that specific environment!

For example, if you generate a token from the KSeF demo portal, you can only perform DD="PL-DEMO" transactions!