E-Invoicing Guide

Quick Start

Step 1 - Enabling the E-Invoicing Feature

To get started with E-Invoicing, please contact your partner manager. They will assist you in activating the E-Invoicing functionality for your company.

Step 2 - Configuration

For issuing E-Invoices, the configuration of base data is required. Details on maintaining this configuration can be found in the chapter API - Base data/company header data and Cfg - Configuration. The necessary base data includes:

- company data

- location data

- E-Invoicing settings

It is possible to set the E-Invoicing configuation in the EFR, though company and location must still be set up in the efsta Portal.

It is very important to fill in the "ContactElectronicMail" field in the configuration to ensure the creator of the E-Invoice receives an email notification in case of an error.

Setting up the E-Invoicing configuration in the EFR

-

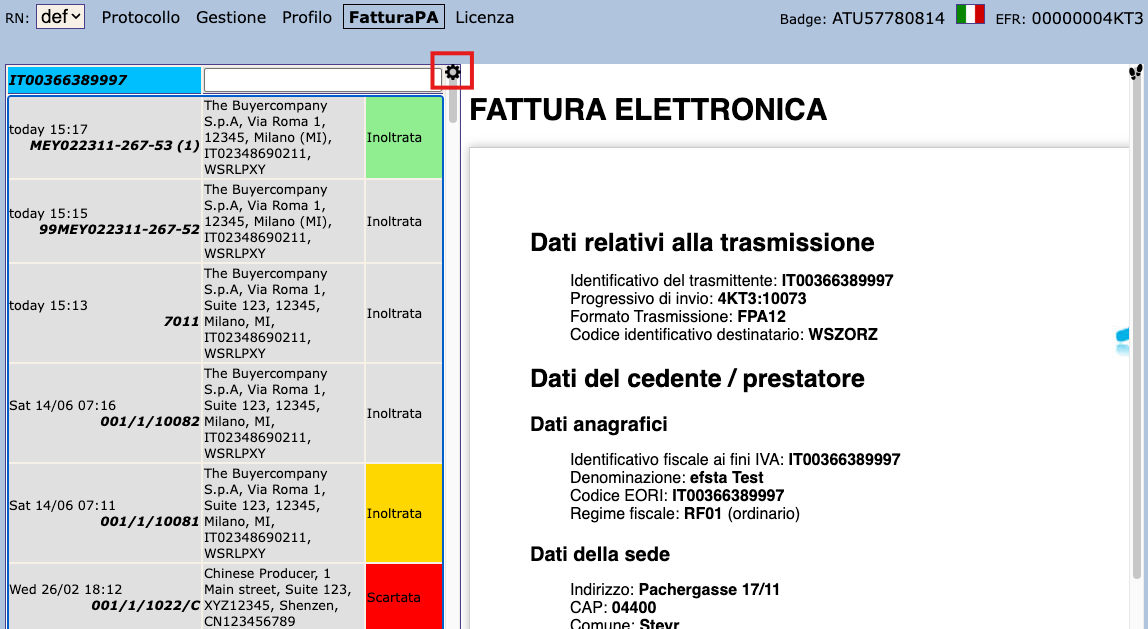

First, please navigate to the E-Invoicing tab in your EFR.

Then proceed by clicking the gear icon at the top of the list.

-

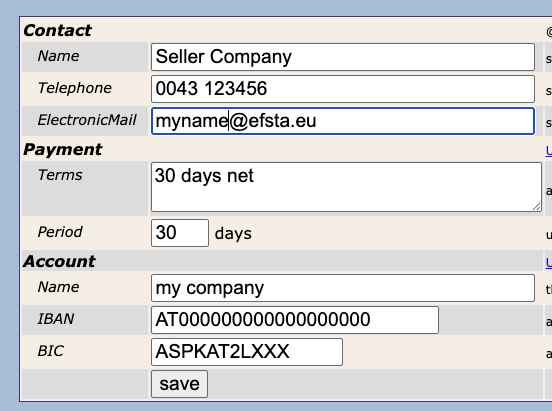

You will be redirected to the page where E-Invoicing settings can be changed.

ATTENTION: IT | PL

ATTENTION: IT | PLStep 3 - Sending

For sending an E-Invoice you have to trigger the electronic delivery.

To do so, please specify ESR.DD (aka "document delivery"), e.g.: DD="IT". Secondly, if required, please also provide the DDto (document delivery to) field.

You can find a detailed overview of the required DD values for each country in the General API Documentation.

For country-specific information on DDto values, please refer to the guides for Germany, Italy and Poland respectively.

Example Request

- JSON

- XML

{"Tra":

{"ESR":

{"DD": "IT-TEST", "DDto": "WSRLPXY", "NFS": "INVOICE",

"Ctm":

{"TaxId": "IT02348690211", "Nam": "The Buyercompany S.p.A", "Adr": "Via Roma 1",

"Zip": "12345", "City": "Milano (MI)"

},

"PosA": {

"Pos": { "PN": "1", "Dsc": "test", "TaxG": "B", "Amt": "1.00"}},

"PayA": {

"Pay": { "Dsc": "Contanti", "PayG": "cash", "Amt": "1.00"}}

}

}

}

<Tra>

<ESR DD="IT-TEST" DDto="WSRLPXY" NFS="INVOICE">

<Ctm TaxId="IT02348690211" Nam="The Buyercompany S.p.A" Adr="Via Roma 1" Zip="12345" City="Milano (MI)"/>

<PosA>

<Pos PN="1" Dsc="test" TaxG="B" Amt="1.00"/>

</PosA>

<PayA>

<Pay Dsc="Contanti" PayG="cash" Amt="1.00"/>

</PayA>

</ESR>

</Tra>

Example Response

- JSON

- XML

{

"TraC": {"SQ": "402", "DDH": "4KT3:402",

"Result": { "RC": "OK"},

"ESR": {"TL": "1", "TT": "1", "D": "2025-07-15T15:15:07", "T": "1.00", "TN": "289",

"TaxA": {

"Tax": {"TaxG": "B", "Prc": "10", "Net": "0.91", "TAmt": "0.09", "Amt": "1.00"}

}

},

"Fis": { "D": "15-07-2025 15:15", "DN": "0052", "ZI": "267", "ID": "99MEY022311"}

}

}

<TraC SQ="402" DDH="4KT3:402">

<Result RC="OK"></Result>

<ESR TL="1" TT="1" D="2025-07-15T15:15:07" T="1.00" TN="289">

<TaxA>

<Tax TaxG="B" Prc="10" Net="0.91" TAmt="0.09" Amt="1.00"/>

</TaxA>

</ESR>

<Fis D="15-07-2025 15:15" DN="0052" ZI="267" ID="99MEY022311"/>

</TraC>