E-Invoicing Guide

Use Cases

Sending

As of right now, there is only one way to send an E-Invoice, though another will be added for your convenience soon:

- sending directly from the transaction

- sending an existing invoice as E-Invoice via the Portal (unavailable)

From Transactions

This is the most common approach and follows the process described in the Quickstart Guide.

To trigger the E-Invoicing module in the transaction:

- Specify the

DDfield (Document Delivery)- e.g.,

DD="IT".

- e.g.,

- If required, also provide the (Document Delivery To)

DDtofield.

If you include these fields in the transaction you send to the EFR, the invoice will also be delivered as E-Invoice.

From the Portal (Unavailable)

This feature is currently not available, but planned in a future release

You will be able to go through your invoices in the portal, select one, and send it as an E-Invoice at a later time as well. This is useful if the electronic delivery was not triggered at the time of the original transaction but needs to be done afterwards, e.g. when a customer asks for an invoice at a later point in time.

Correcting

There are several use cases for correcting invoices. Depending on the scenario, different actions are required.

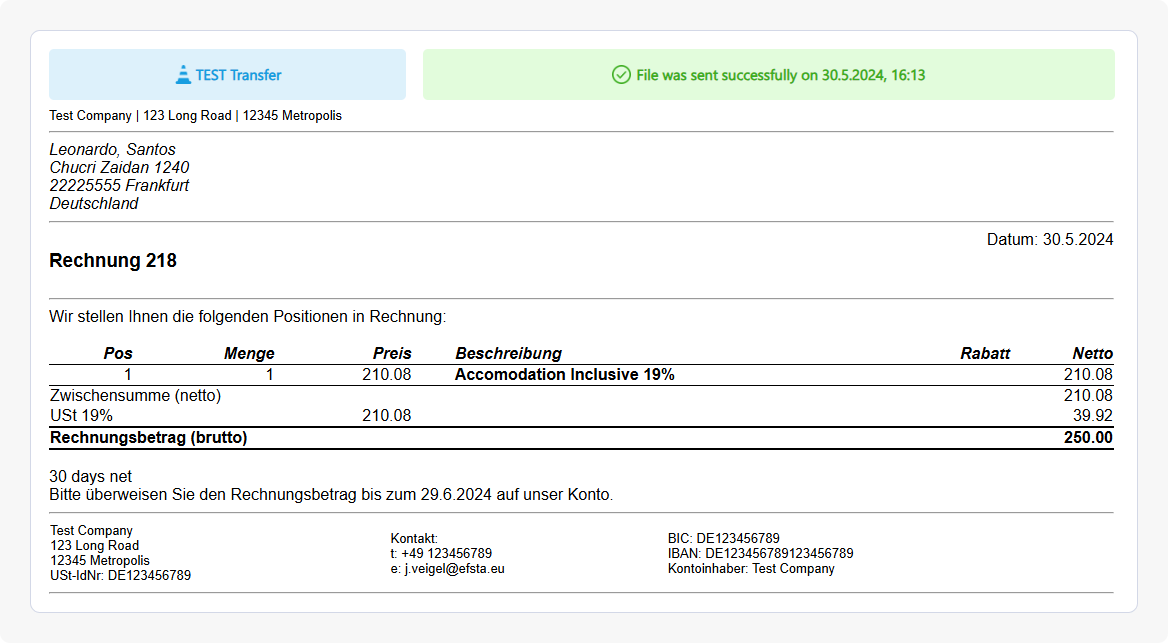

Delivery Error

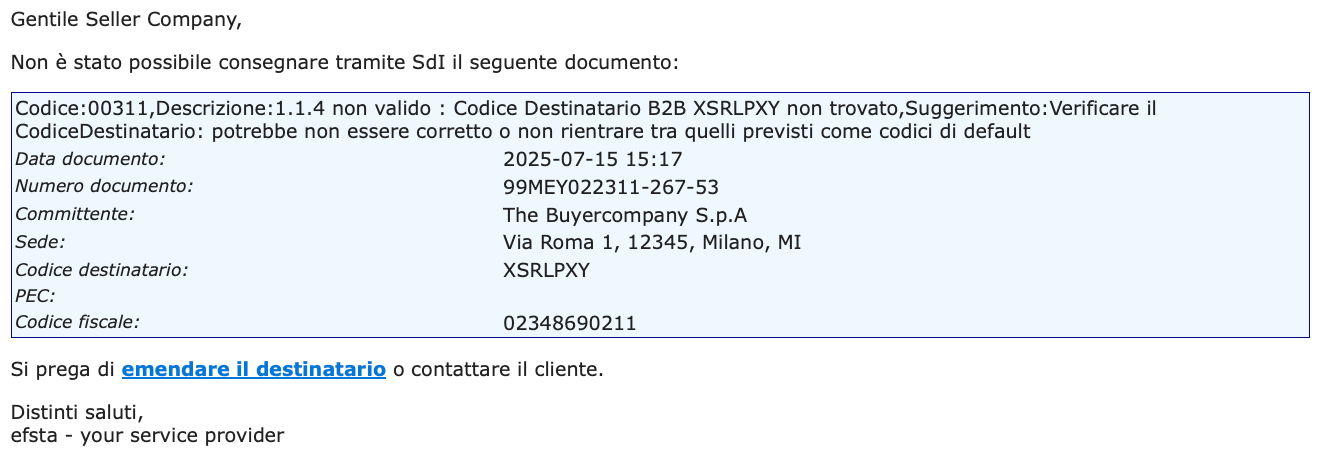

It is very important to fill in the ContactElectronicMail field in the configuration to ensure the creator of the E-Invoice receives an email notification in case of an error.

If an error occurs during delivery, an email notification will get sent to the email address specified in ContactElectronicMail. The email contains a detailed description of the error, as well as a link to correct the specific invoice's data and resend it.

The previously generated E-Invoice is also attached.

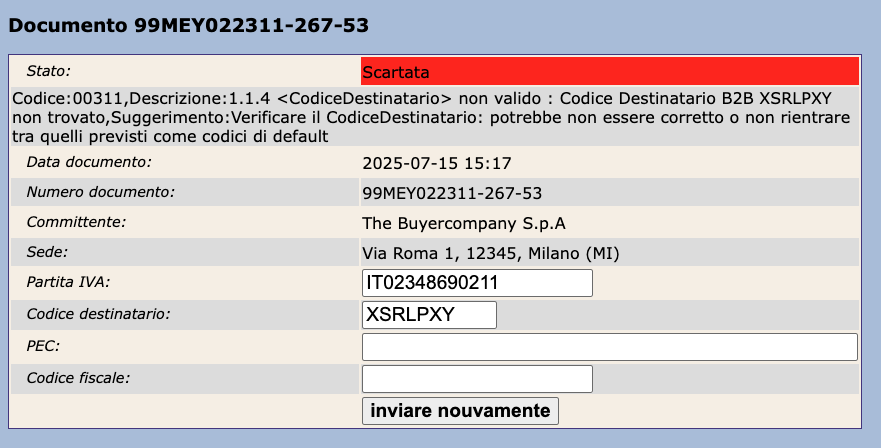

Clicking the link within the email will lead you to a setup page for the EFR where you can correct the available data and resend the E-Invoice.

This functionality is available for all supported countries.

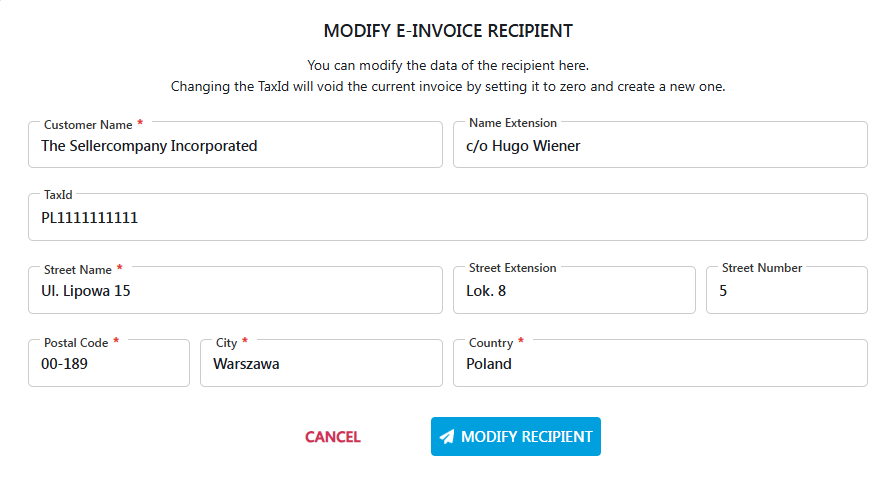

Modify Recipient  (Poland)

(Poland)

If you need to modify customer-related data such as the name, address or TaxId, this can be done via the portal.

Process

With a click on the edit button (which is right next to the blue download button) a new window opens where its possible to update the recipient of the selected E-Invoice.

Changing the TaxId will automatically void the current E-Invoice and issue a new one with the updated TaxId.

This feature is only available in Poland. Please contact your partner manager about enabling it in other countries, if required.

Monitoring

Monitoring can take place in the Portal or directly at the EFR, depending on your preference. Filtering the available E-Invoices is only available in the Portal however.

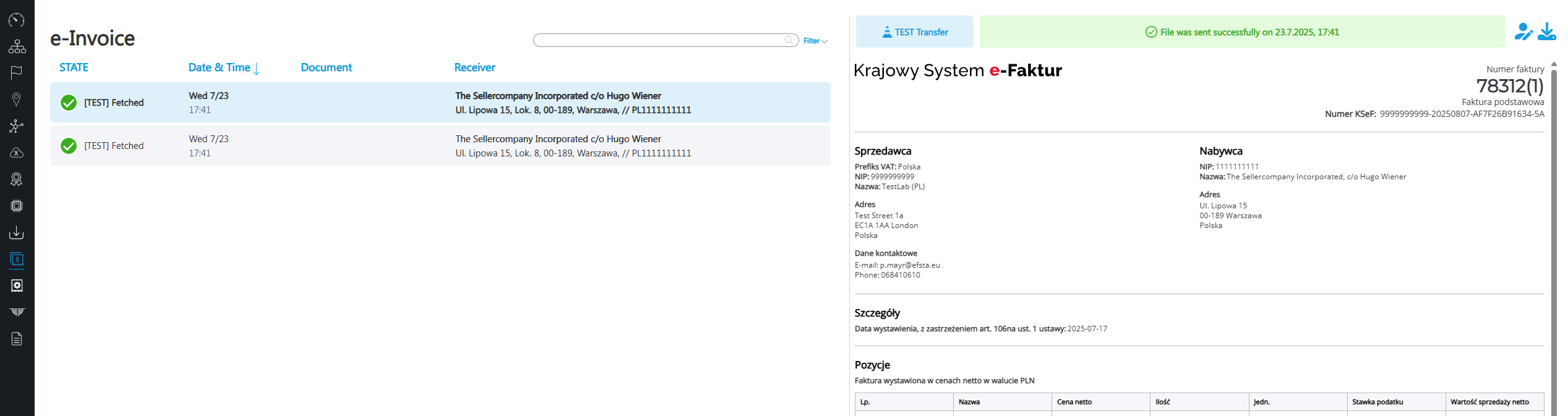

Portal

- The Portal provides an overview of the E-Invoices created for each company.

- You can also see whether the invoice was sent successfully or if an error occurred.

- Furthermore, you can filter results by date or status.

When an invoice is opened, it is displayed on the right side, offering more details about the invoice.

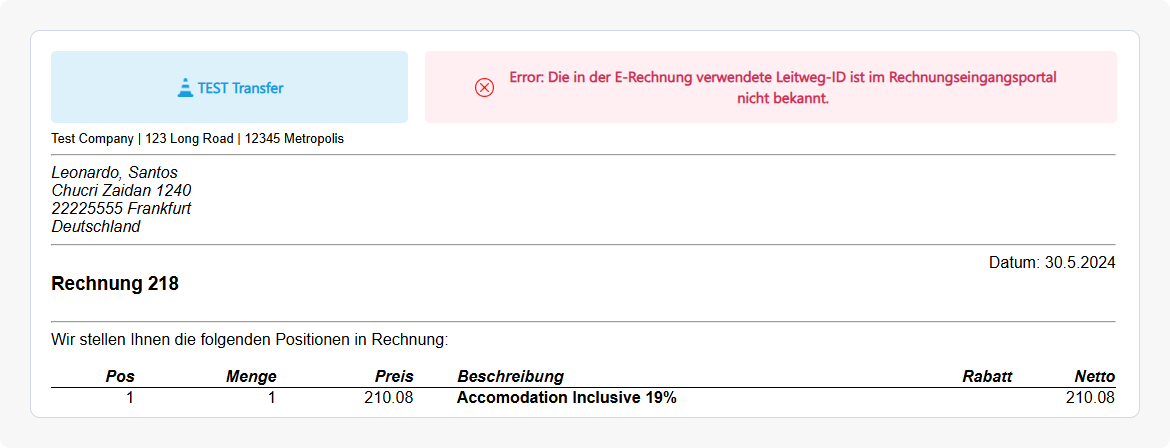

If an error has occurred, you will see a detailed description of the error in the banner above.

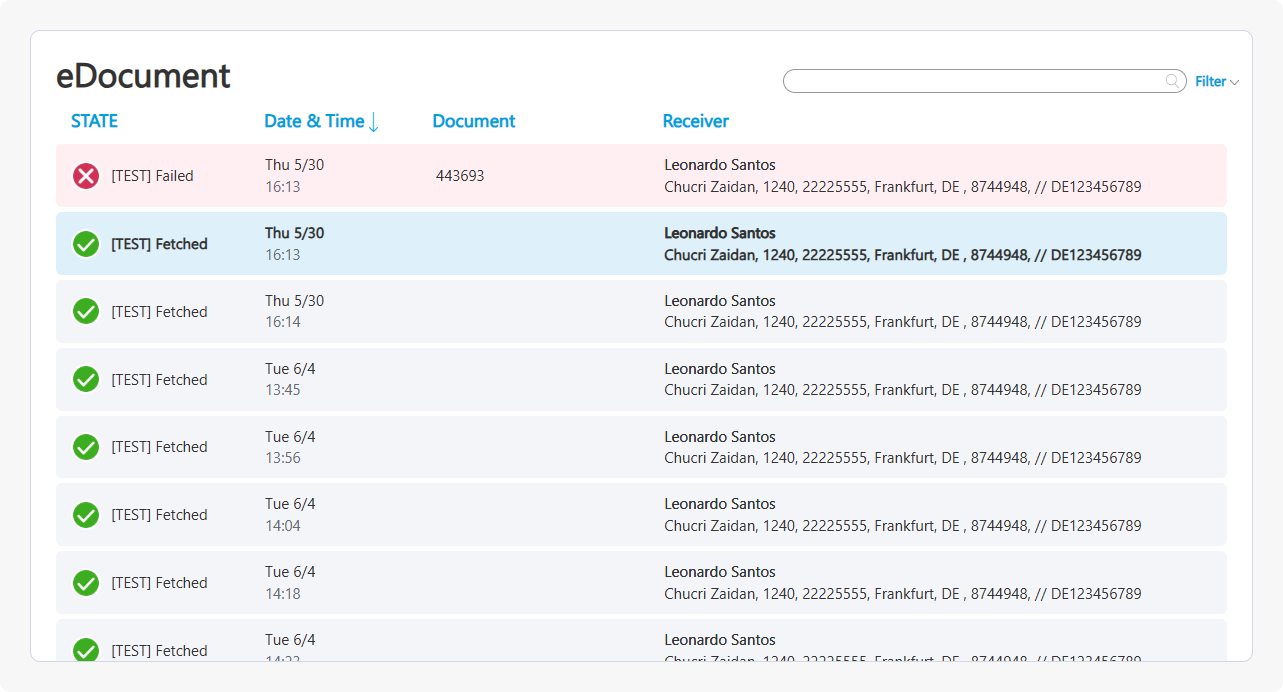

EFR

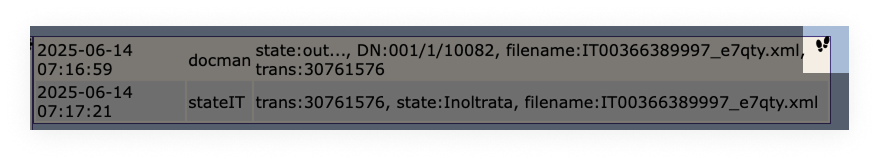

You can also view your E-Invoices directly in the EFR under the corresponding Tab.

Here, you will get an overview of all invoices with their state, which gets updated after a specific interval. It is therefore not neccessary to refresh the site manually.

Furthermore, clicking on the footstep-icon allows you to track the invoice and access all related processing details.