VERI*FACTU

We are now covering VERI*FACTU for mainland Spain with VAT and the Canary Islands with IGIC. If you require an extension to other Spanish regions, please get in touch with your contact at efsta.

VERI*FACTU was launched by the Spanish government to improve transparency and security in tax reporting. The standardized transmission of tax-relevant data is intended to effectively combat tax fraud and irregularities. The regulation primarily affects companies that use invoicing software to process sales and other tax-relevant transactions.

Requirements

Billing systems must meet the requirements of VERI*FACTU for integrity, preservation, accessibility, legibility, traceability, and unalterability of billing records which are the following:

- Records cannot be altered without the Tax Agency's computer system detecting and alerting to this

- The transactions need to be linked so that their trail can be verified by following their creation sequence from the first to the last. All data must be correctly dated, indicating the time at which the record was made.

- The billing system must ensure that records are kept for the legally established period and that they are accessible and legible throughout that period. It must also allow for the secure download, dumping, and archiving of billing records, which must be able to be exported to external storage in a readable electronic format.

- An "event log" is not required because the preservation, legibility, and accessibility of their billing records are guaranteed by their registration in the Tax Agency's Electronic Office.

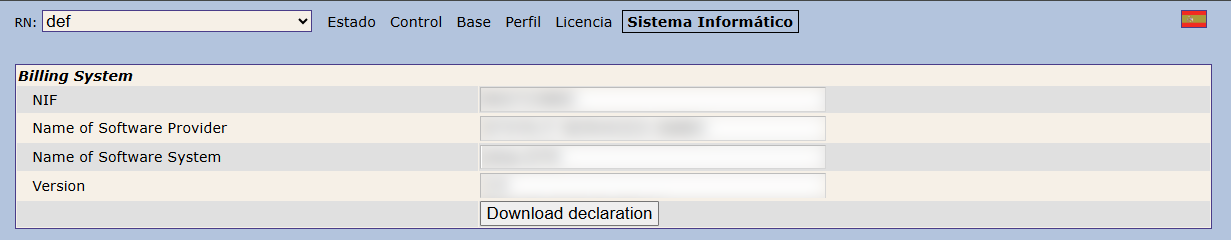

Software Information for On-Site Verification

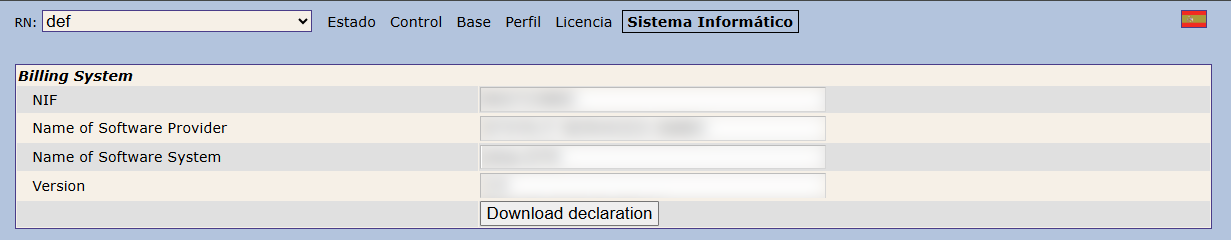

Identification of the software that enables on-site verification of information on a single screen. The VERI*FACTU software includes an on-site verification functionality, through which the following information is displayed on a single screen of the billing device:

- Tax identification number and the full name or company name of the person or entity that developed the VERI*FACTU compliant software used on the device.

- Name of the company that developed the VERI*FACTU compliant software on the device

- Name of the VERI*FACTU software used on the device.

- Version of the VERI*FACTU software used on the device.

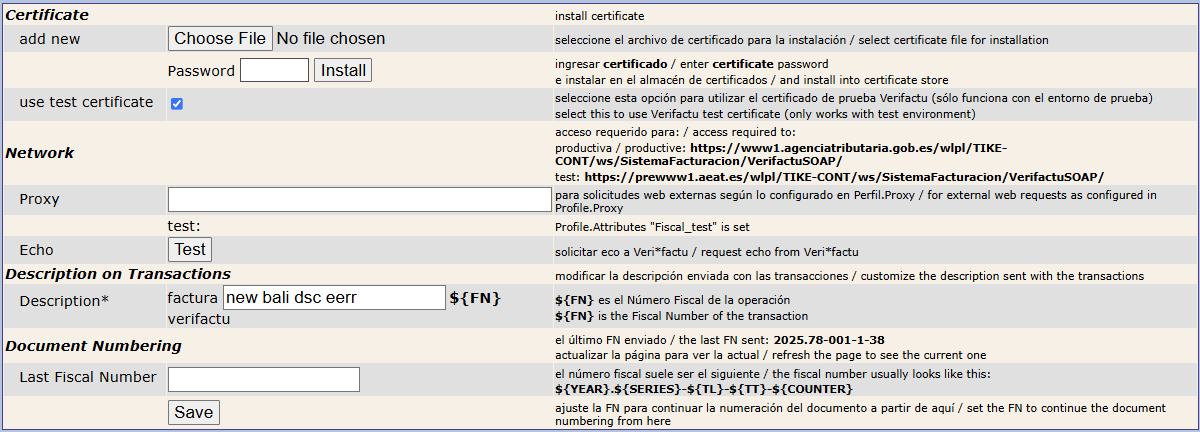

Updating the Test Certificate

This is relevant for EFR version 2.5.6.1b and newer.

Installation

- Go to efsta download page and download latest version

- Set the TaxID to: N0272386D

- Select the VERI*FACTU region in the config

- Set a company name (it may not be empty)

- Select the checkbox in the Control page:

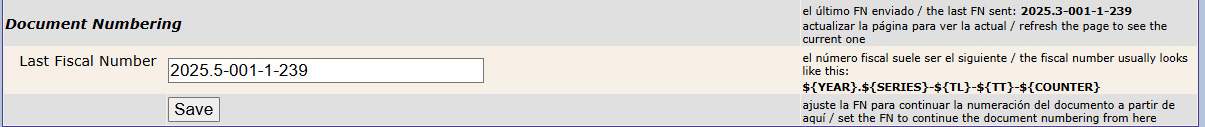

Duplicate FN (transaction ID)

One limitation of this version is that, by using the same certificate, it can happen that the same FN will be generated on multiple systems if installed on the same day. This can lead to VERI*FACTU sending an error message about duplicate transaction codes:

The issue can be solved by either changing the TL/TT through requests (in this case, the config will have to be updated in the UI) or using the Fiscal Number setting on the Control page:

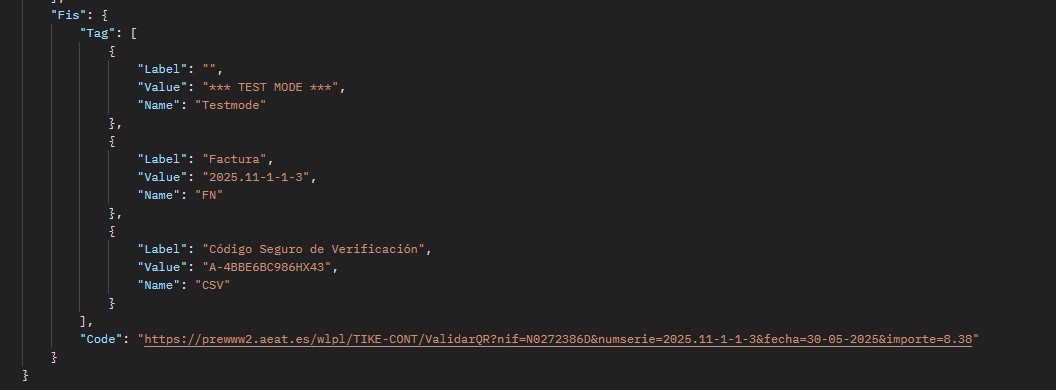

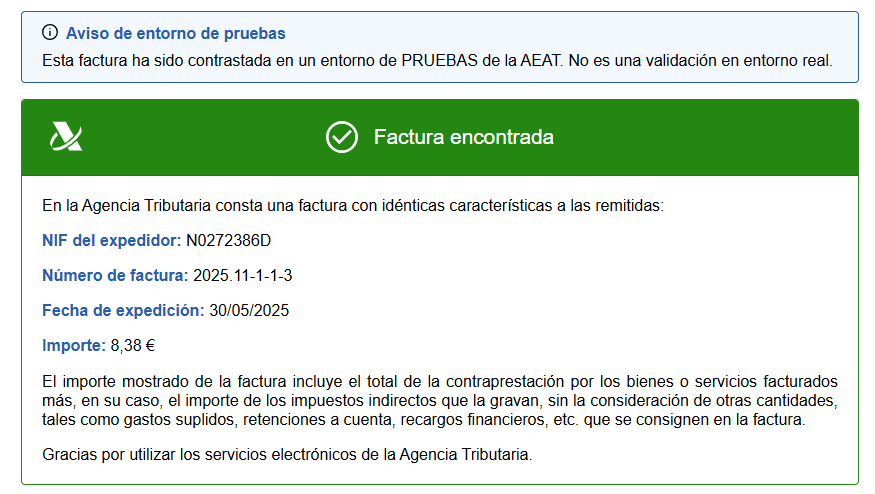

Verifying transactions

A successful transaction can be verified with the link in the response (e.g. https://prewww2.aeat.es/wlpl/TIKE-CONT/ValidarQR?nif=N0272386D&numserie=2025.11-1-1-3&fecha=30-05-2025&importe=8.38) If copied, this link will show if the transaction was successfully registered in the test env of VERI*FACTU.

Our certificate can only be used with VERI*FACTU and it will only send the requests to the test environment, so we don't accidentally fiscalize a real transaction

IGIC Tax Regime (Canary Islands)

This region is only available in the newest version of EFR ES (2.6)

IGIC stands for "Impuesto General Indirecto Canario". In the Canary Islands, IGIC replaces VAT as the applicable consumption tax, with different rates specific to the region.

If you want to operate the EFR with VERI*FACTU in the autonomous community of the Canary Islands, you will have to select this region in the Base config page.

Please mind that different tax rates apply for this region compared to mainland Spain and Basque provinces. More information can be found at VAT Handling.

Certificate Setup

Understanding VERI*FACTU and Digital Certificates

What is VERI*FACTU in simple terms and what is it for?

VERI*FACTU is a new system promoted by the Spanish Tax Agency (Hacienda) in Spain. Its main purpose is to modernize and make the way invoices are issued and recorded more secure. Think of it as a significant update so that all invoices are recorded in a way that is difficult to alter, thus seeking greater transparency in commercial operations.

The fundamental objective of VERI*FACTU is to combat tax fraud, ensuring that invoice information is correct and complete. In addition, it seeks to facilitate the fulfillment of tax obligations for companies and freelancers, and promote digitalization. For businesses, this means that invoicing software must be adapted to comply with these new requirements.

This system should not only be seen as a new obligation. The implementation of VERI*FACTU seeks to create a more equitable and transparent business environment. By reducing the possibility of invoice manipulation, it aims to reduce unfair competition derived from tax evasion. For the entrepreneur or freelancer, adapting to VERI*FACTU can result, in addition to regulatory compliance, in greater credibility with their customers and a smoother and clearer relationship with the Tax Agency. The digitalization and standardization of invoicing records are steps towards a more robust tax system where trust is based on the capacity to reliably verify information.

Why is a "digital ID card" (certificate) needed for VERI*FACTU?

For the VERI*FACTU system to function correctly and meet its security and transparency objectives, it is crucial that the Tax Agency can trust the information it receives. It needs to be certain of two fundamental aspects: first, that the invoice or invoicing record has actually been sent by the company or freelancer it claims to be; and second, that this information has not been modified or altered since it was generated. Here is where the digital certificate comes into play.

A digital certificate acts like a "digital identity card" or a "digital company seal." It is an electronic file containing information that uniquely identifies a natural person (freelancer) or a legal person (company) in the digital world. This certificate is used to perform an "electronic signature" on the invoicing records that are sent to Hacienda under the VERI*FACTU system.

This electronic signature, made with the digital certificate, provides two essential guarantees:

-

Authenticity:

Confirms who the issuer of the invoicing record is. It assures Hacienda that the record legitimately comes from the taxpayer (natural person or company) who owns the certificate. -

Integrity:

Guarantees that the content of the invoicing record has not been modified after being signed. If someone were to try to change any data, the electronic signature would be invalidated, alerting to the alteration. Without a valid digital certificate, the invoicing software could not generate this essential electronic signature, and therefore, could not comply with the security and reliability requirements demanded by VERI*FACTU for sending transactions.

Confidence in the entire VERI*FACTU system rests, to a large extent, on the robustness of these digital certificates. They are the pillar that allows verifying that the data is correct and comes from a legitimate source. It is not a mere technical formality, but the component that enables the fundamental guarantees of inalterability, integrity, and authenticity that VERI*FACTU seeks to establish. Without the certificate and the electronic signature it allows, there would be no reliable way to ensure who sent the invoicing information and whether that information is original and has not been manipulated.

Choosing a Digital Certificate for VERI*FACTU

Not all digital certificates are the same or serve the same purpose. To comply with VERI*FACTU, a type of certificate will be needed that depends on whether the invoicing party is a freelancer or a company, and how the signing process will be carried out: whether a person will do it directly or if you want the invoicing software to do it automatically. The most common format in which a digital certificate is delivered as a downloadable file is P12 (sometimes also referred to as PFX). This file is, in essence, the container of the "digital ID card" and the information needed to sign.

Option 1: Natural Person Certificate (or Freelancer Certificate) – If the signing is done by the individual themselves

-

Who is this certificate for?

This is the appropriate option for freelancers or individual professionals who will be the ones who, using their invoicing software, authorize and digitally sign the sending of each invoice or invoicing records to Hacienda. It can also be used by a natural person acting on their own behalf. -

How does it work?

This certificate is personal and non-transferable. When sending data to VERI*FACTU, the invoicing software will request the use of this certificate to perform the electronic signature, similar to signing a paper document, but digitally. -

Relevance:

Identifies the individual as the person responsible for the signature.

Option 2: Legal Entity Representative Certificate – If a specific person signs on behalf of the company

Who is this certificate for? It is intended for companies (limited companies, public limited companies, etc.) where a specific natural person, such as the administrator, a CEO, or an attorney with sufficient powers, is the one who has the authority and responsibility to digitally sign on behalf of the entity.

-

How does it work?

Although used by a natural person, the certificate proves that said person is acting in representation of the company. The signature made with this certificate legally binds the legal entity. -

Relevance:

It is necessary when the signing of VERI*FACTU transactions must be performed by an individual with the legal capacity to represent the company.

Option 3: Company Seal Certificate – For the invoicing software to sign "automatically"

-

Who is this certificate for?

This is the ideal option for companies seeking a high degree of automation in their invoicing and VERI*FACTU sending processes. This certificate is not linked to a natural person, but to the entity itself. -

How does it work?

It is installed on the system or server where the invoicing software operates. The program uses this "digital seal" to sign invoicing records automatically, without requiring a person to manually intervene to authorize each signature. It is like a traditional company rubber stamp, but with legal validity in the digital environment. -

Relevance:

It is the best option for companies with a considerable volume of invoices or those that wish to maximize their processes, eliminating the dependence on a manual signature for each VERI*FACTU submission.

Recommendation: Freelancer or company? Manual or automatic signature?

Choosing the correct digital certificate is not just a technical decision, but it has a direct impact on how invoicing and VERI*FACTU compliance will be managed on a daily basis.

-

If you are a freelancer: The most common and generally suitable option will be the Natural Person Certificate (or Freelancer Certificate). With this certificate, the freelancer themselves is responsible for signing their invoicing records.

-

If you are a company:

- If you prefer or require a specific person (administrator, attorney) to be the one who authorizes and digitally signs submissions, then the Legal Entity Representative Certificate is the one indicated. This generally involves a signing action, which can be manual or assisted by the software, by said representative.

- If the company seeks maximum automation and wants the invoicing software to manage signatures without constant personal intervention, the Company Seal Certificate is the most appropriate solution. This certificate is precisely designed for automated processes.

It is essential to understand this distinction: natural person and representative certificates are intrinsically linked to an individual, and their use for signing implies an action or validation by that individual. In contrast, the company seal certificate is conceived so that computer systems can sign on behalf of the entity unattended. Therefore, the choice will define whether the signing process will be an active step by the user or an integrated and automatic function of the invoicing system.

Easy Guide to Obtaining Your Digital Certificate (P12 File)

Obtaining a digital certificate may seem complicated, but by following some general steps, the process is quite accessible. Below, we describe how to obtain it, focusing on the P12 file format, which is the one that will contain your "digital key."

Where to get it?

In Spain, there are several entities authorized to issue digital certificates, known as Trust Service Providers. The most common for users are:

-

FNMT (Fábrica Nacional de Moneda y Timbre - Real Casa de la Moneda) (RECOMMENDED)

This is the most widely used public entity and offers certificates for natural persons, company representatives, and others. -

Camerfirma

This is a certification entity linked to the Chambers of Commerce of Spain, which also offers a wide range of certificates.

Other recognized providers include Izenpe (For Ticketbai), ANF Autoridad de Certificación, and the Agència Catalana de Certificació (CATCert), among others. The process of obtaining them is usually similar in its fundamentals, although specific details may vary.

Simplified general steps (example with FNMT for Natural Person, the most common for freelancers)

The process of obtaining an FNMT Natural Person certificate, which is typically needed by a freelancer, can be summarized in the following steps:

-

Computer Preparation: Before starting the application, the FNMT requires the installation of software called "Configurador FNMT-RCM". This program prepares the browser and the computer to securely generate the certificate keys. It is downloaded free of charge from the FNMT website and its installation is simple.

-

Online Application: You must access the FNMT Electronic Headquarters, go to the section of "Obtain Electronic Certificates", and select "Natural Person". There you start the online application, where you will be asked for data such as your NIF/NIE, first surname, and an email address. At the end of this step, the system will send a Request Code to the email address provided. It is crucial to save this code.

-

Identity Verification (confirm who you are): With the Request Code and your original and valid identification document (DNI for Spaniards; NIE and passport for foreigners), the applicant must appear in person at an authorized Registration Office. Many of these offices are Tax Agency administrations, Social Security offices, or other collaborating bodies. The purpose of this step is for an official to physically verify the applicant's identity. Some entities such as Camerfirma also offer the possibility of completing this step through video identification, avoiding travel.

-

Certificate Download (P12 file): After a short period following the verification (it can be from an hour to a day, depending on the office), you can download the certificate from the FNMT website. To do this, you will need your NIF/NIE and the Request Code again. During this download process, the system will ask you to set a password to protect the certificate file. This password is fundamental and must be remembered and stored securely. The file downloaded is the certificate in P12 (or PFX) format.

It is very important to remember that, generally, the entire process of applying for and downloading the certificate must be done from the same computer and using the same browser and user profile. You should not format the computer or make significant changes to the browser between the application and the download.

What documents might you need?

The exact documentation may vary slightly depending on the type of certificate and the provider, but generally:

- For a Natural Person or Freelancer Certificate:

- The original and valid DNI (National Identity Document) or NIE (Foreigner Identification Number) of the applicant.

- The Request Code obtained in the online step.

- Some providers like Camerfirma, for the specific freelancer certificate, may additionally require documentation proving registration in the Special Regime for Self-Employed Workers (RETA), such as AEAT form 036 or 037, and the last contribution receipt.

- For a Legal Entity Representative or Company Seal Certificate:

- The original and valid DNI or NIE of the natural person acting as a representative.

- The Request Code.

- Documentation proving the existence of the company (CIF - Company Tax Identification Code).

- Documentation proving the powers of representation of the natural person applying for the certificate on behalf of the company (for example, public deeds of incorporation and appointment of administrator, notarized powers of attorney, recent registry certificates). For foreign entities, this documentation must be translated and apostilled.

Practical advice: Before starting any procedure, it is essential to visit the website of the chosen certificate provider (FNMT, Camerfirma, etc.) and consult the section of "required documentation" for the exact type of certificate that is going to be requested. This will save time and possible unnecessary trips.

Cost and duration: An approximate idea

The costs and validity periods of digital certificates vary according to the type of certificate and the issuing entity:

Natural Person Certificate (issued by FNMT)

Generally free of charge. The typical validity is 4 years.

Natural Person or Freelancer Certificate (issued by Camerfirma)

It has a cost of around €35 - €40 (VAT not included) and a validity of 2 years.

Legal Entity Representative Certificate (issued by FNMT)

The cost is €14 (taxes not included) and it has a validity of 2 years.

Legal Representative Certificate (issued by Camerfirma)

The cost is from €80 (VAT not included) and its validity is of 2 years.

Company Seal Certificate (issued by Camerfirma)

Prices begin at €250 for a validity of 1 year, with options of up to 4 years (with the consequent price increase, for example, €750 for 4 years). The FNMT also offers an "Entity Seal Certificate", with validity of 1, 2 or 3 years and costs that must be consulted with its commercial area; however, its specific suitability for automated VERI*FACTU signing by private companies (not Public Administrations) is not as clearly defined in the available information as the Representative or specific Company Seal certificates from other providers.

These prices and validity periods are indicative and may have changed. It is recommended to always verify the most updated information directly on the website of the certificate provider before starting the application.

What Digital Certificate Do I Need for VERI*FACTU? (Quick Guide)

To simplify the choice of the most appropriate certificate, the following table summarizes the main options based on the user's situation and signing method:

| User Situation | Recommended Certificate | Who/What Uses It for Signing? | Main Provider (Example) | Approximate Cost (without VAT) | Typical Validity |

|---|---|---|---|---|---|

| Freelancer (signs their invoices themselves) | Natural Person Certificate (FNMT) / Digital Freelancer Certificate (Camerfirma) | The freelancer themselves | FNMT / Camerfirma | Free (FNMT) / From €35 (Camerfirma) | 4 years (FNMT) / 2 years (Camerfirma) |

| Company (a specific person will sign invoices) | Legal Entity Representative Certificate | The legal representative or attorney | FNMT / Camerfirma From €14 (FNMT) / From €80 (Camerfirma) | 2 years | |

| Company (wants invoicing software to sign "automatically") | Company Seal Certificate | The invoicing software (automatically) | Camerfirma / FNMT (Entity Seal*) | From €250/year (Camerfirma) | 1-4 years |

- For the FNMT Entity Seal Certificate, it is recommended to verify with them its applicability and exact process for automated signing in VERI*FACTU by private companies, as the information is less direct for this specific use compared to the Representative or Seal certificates from other providers. This table aims to be a quick guide. The final choice will depend on the operational needs and invoicing volume of each taxpayer.

Your P12 Certificate in Action with VERI*FACTU

Once the digital certificate has been obtained in P12 format, it is important to understand what this file is, the importance of its password, and how it interacts with the invoicing software to comply with VERI*FACTU.

The P12 file: Your personal or company "digital key"

Upon completion of the certificate download process, you will obtain a file with the ".p12" or, in some cases, ".pfx" extension. These extensions indicate that the file follows a cryptographic standard (PKCS#12) that bundles both the digital certificate (the public part that identifies the holder) and its corresponding private key (the secret part that allows for signing). This P12 file is, in effect, the materialization of the digital identity of the user for VERI*FACTU procedures; it is the "key" that will allow for electronic signing.

This file is personal and non-transferable if it is a natural person or representative certificate, as it is linked to the identity of an individual. If it is a company seal certificate, although it identifies the entity, its custody and use must also be rigorous. The possession of this file and the knowledge of its password are equivalent to having the ability to sign on behalf of the certificate holder.

Your certificate password: A treasure to protect!

During the process of downloading the P12 certificate from the issuing entity (like the FNMT) or when exporting a backup copy from the browser, the system will ask the user to establish a password to protect said file.

This password is absolutely vital. It acts as the security key that protects access to the private key contained within the P12 file. Without this password, the certificate cannot be used to sign. If the user forgets this password, generally there is no way to recover it, and the only solution would be to request a new certificate from the beginning, repeating the entire obtaining process from the start, including identity verification.

It is crucial to save this password in an extremely secure place, preferably separated from the P12 file itself, and not share it with anyone who is not duly authorized to use the certificate on behalf of the holder. The security of the P12 certificate and, therefore, of the digital identity for VERI*FACTU, depends directly on the strength and proper management of this password. A P12 file with a weak password or known by unauthorized persons represents a significant security risk, as it would allow for identity impersonation.

How does your invoicing software use it? (In simple terms)

The user, or the person in charge of technical support or the provider of the invoicing software, must "load", "install" or "configure" this P12 file (along with its password) in the invoicing software that is compatible with VERI*FACTU. Once configured, the software will use this certificate to comply with the requirements of VERI*FACTU. When an invoice (or a set of them that must be communicated to the Tax Agency) is generated, the program will internally access the certificate and its private key to digitally "sign" the invoicing record before sending it, or to sign the XML file that is sent to Hacienda.

The mode of interaction can vary:

-

If a Natural Person Certificate or Legal Entity Representative Certificate is used, it is possible that the software requests the certificate password each time a signature or submission is to be made, or at least the first time during a work session. This ensures that the authorized holder or representative is present or consents to the operation.

-

If a Company Seal Certificate is used, the software is usually designed to use it in a more automatic or "unattended" way, signing records without requiring manual intervention for each transaction, which is ideal for high-volume processes.

In essence, the invoicing software acts as the "executor" of the electronic signature, but it always does so using the digital identity and cryptographic keys provided by the certificate that the user has configured in it. The user does not need to know the complex technical details of cryptography; they only need to ensure that their software is correctly configured with a valid certificate.

Important note: Your tax advisor might ask for this certificate

It is a common practice that managers or tax advisors ask their clients (freelancers or companies) for the digital certificate file (the P12 file) and its corresponding password. This allows them to carry out various telematic procedures before the Tax Agency and other administrations on behalf of their clients, such as filing taxes.

With the arrival of VERI*FACTU, it is very likely that the tax advisor will also need access to the certificate to manage the sending of the invoicing records or to help in the initial configuration of the client's invoicing software, if the client delegates this to them. In fact, some advisory firms are even becoming On-site Verification Points to facilitate the obtaining of certificates for their clients.

It is essential to be cautious when sharing this information. The digital certificate and its password grant the ability to act and sign digitally on behalf of the holder. Therefore, it should only be shared with professionals of absolute trust and, preferably, understanding the scope of the permissions being granted.

Don't Lose Your Certificate! The Importance of Backing Up

A digital certificate, especially in its P12 file format, is a valuable and sensitive digital element. Losing it or having it damaged can cause significant inconveniences. Therefore, performing a backup copy is a fundamental precautionary measure.

Why is it vital to have a copy?

The P12 file that contains the digital certificate and its private key is normally stored on the hard drive of the computer where it was downloaded or installed. If that computer suffers a breakdown, is stolen, or if the file is accidentally deleted, access to the digital certificate is lost.

Having a backup copy allows you to restore the certificate on the same computer after a problem, or install it on a new computer if necessary. Without a valid backup copy (which includes the private key and whose password is remembered), the only alternative in case of loss of the original certificate is usually to request a completely new one, which implies repeating the entire obtaining process from the beginning, including identity verification.

How to make a copy (very simple explanation of "exporting" the P12 file)

Once the digital certificate is installed in the web browser (like Google Chrome, Mozilla Firefox, Microsoft Edge) or in the operating system's certificate store (Windows, macOS), there is the possibility of "exporting" it to create a backup copy. This process generates a new P12 (or PFX) file.

The exact steps may vary slightly depending on the browser or operating system, but the general idea is the following:

-

Access the browser settings, usually in sections called "Privacy and Security", "Security", or directly "Certificates"

-

Locate the certificate you want to export in the list of installed personal certificates

-

Select the option to "Export" or "Back up"

During the export assistant, a crucial option will appear: "Export the private key". It is essential to check this box. If the private key is not exported, the resulting backup copy (which would often have a .cer or .crt extension) will only contain the public part of the certificate and will not work for electronic signing, which is its main function for VERI*FACTU.

-

The system will ask you to create a new password to protect the backup file (the P12). This password can be different from the one used to originally download the certificate or the one used for the main P12. It is vital to choose a secure password and remember it, as it will be necessary to be able to import and use this backup copy in the future.

-

Finally, the P12 file will be saved in the location chosen by the user. The key to a functional backup copy is, therefore, to ensure that the private key is included during the export. Without it, the P12 file generated will not allow for digital signatures.

Save the copy in a safe place

The backup copy of the P12 file should not be stored only on the same computer where the original certificate is located. If the computer's hard drive fails, both copies would be lost.

It is strongly recommended to save the backup P12 file on an external storage device, such as a USB memory (pendrive) or an external hard drive. Another option is to use a secure and trusted cloud storage service, protecting access to said service.

It is equally important to save the password of this backup copy in a safe place and, if possible, separated from the P12 file itself.

What happens if my certificate expires?

Digital certificates are not valid indefinitely; they have an expiration date (commonly 2 to 4 years, depending on the type and the issuer).

An expired certificate is no longer valid to sign electronically. Therefore, in order to continue issuing invoices and sending the records to the VERI*FACTU system without interruptions, it is essential to renew the certificate before its expiration date arrives.

The renewal process is usually simpler if it is started while the current certificate is still valid. Many providers allow renewal online if the holder's circumstances have not changed. It is the user's responsibility to be aware of the expiration date of their certificate and act in advance to ensure the continuity of their ability to comply with VERI*FACTU obligations.

Declaration of Conformity

(Also called Responsible Declaration)

Under the VERI*FACTU rules in Spain, specifically Article 15 of the Ministerial Order for certified billing systems, all VERI*FACTU Invoicing Systems (SIF) must be confirmed as compliant. This confirmation is mainly done by providing a Declaration of Conformity from the software system maker. The current law does not require any extra official certification or registration process besides this declaration.

As the provider of the middleware that connects with Point of Sale (POS) systems for VERI*FACTU compliance, efsta will give you a Declaration of Conformity for our middleware. This declaration will be for each version of our system. VERI*FACTU rules require this declaration to be easy to access and see through the integrated POS or billing software for the end user.

The efsta Declaration of Conformity for our middleware can be accessed here.

It can also be found at our ES download page, the "Sistema Informatico" tab in the EFR, as well as using the/declarationpath from the EFR API

- The Declaration of Conformity(s) must be available through the POS or billing system that uses our middleware

- These declarations should be given to the taxpayer (your customer) when they buy or get the integrated system

Besides the Declaration of Conformity provided by efsta for the middleware, as someone integrating our solution, you might need to provide and show through the POS an extension or your own Declaration of Conformity. This declaration should cover the integrated POS or billing software itself. This is to make sure the compliance of the full system is documented.

You can download the official template for the Declaration of Conformity as a PDF in Spanish (mandatory) and English (optional).

We have also prepared a guide for developers in english, explaining how to set up the declaration for invoicing systems here.

- It is very important to keep and be able to provide all Declaration of Conformity documents issued for older versions of the software parts that make up the VERI*FACTU system.

- In case of an audit, only the Spanish version of the declaration is valid. Other languages can be provided in addition, but will not be valid on their own.

For more information on this topic, please visit the official website!

Further Information

This guide is general and simple - the objective has been to explain in the clearest and simplest way possible the fundamental aspects of digital certificates and their use in the VERI*FACTU system, especially for people with less technical experience. Some concepts have been simplified to facilitate understanding. The regulations of VERI*FACTU and the exact procedures for obtaining and using certificates may involve technical details or particular situations that have not been addressed in depth here to maintain the simplicity of the text.

For specific questions about your situation or if you need more detailed help, please get in touch with your contact at efsta.

If, after reading this guide, the user still has doubts about what type of certificate is most suitable for their specific case, how to configure it in the invoicing software, or encountering any technical difficulties, it is highly recommended to seek specialized advice from us. To do this, the commercial department of efsta IT Services GmbH is available to offer personalized guidance and resolve specific queries related to the implementation of VERI*FACTU and the use of digital certificates in our solutions. We, as experts in the matter, will be able to provide the most precise and adapted assistance to each particular situation.

Adapting to new systems like VERI*FACTU can generate questions, and counting on the support of professionals is key to ensuring correct and efficient compliance. Although this guide seeks to simplify the process, expert assistance will always be the best resource in complex scenarios or persistent doubts.

For further information on VERI*FACTU you can also visit the official documentation website and use the klickable guide at the bottom for your convenience.