Austria

Frequently Asked Questions

General

How can I change the company's legal name?

- Decommissioning: localhost:5618 → Control → Create final receipt - wait until it is also available in the cloud (efsta portal) and the deregistration has been confirmed by the finance department (FISCAL_AT-CLOSE--P-.).

- Check whether the recorder is online and all transactions are available in the cloud, uninstall EFR and archive/delete data

- Deactivate EFR and possibly old company in the efsta Portal

- Create the new company in the Portal incl. FON user

- Reinstall EFR (download for AT here: http://public.efsta.net/efr/ )

- Browser call Localhost:5618 - Configure profile page (badge, prime sign,...)

- Wait until the final receipt from the old cash register is provided with P (efsta portal)

- Send a transaction and the start receipt will be generated automatically.

- FON reactivation is only necessary if the start command was created before the correct FON data was entered in the Portal

Please inform your Partner Manager when everything is done to ensure that billing is switched to the new company.

How do I create a starting-, monthly- and annual receipt?

Starting Receipt

Is created automatically with the first transaction sent from the cash register to the ERA. This process does not have to be carried out manually.

Monthly Receipt

Is created automatically with the first transaction in the new month.

Year-end Receipt

Is created automatically with the first transaction in the new year.

Final Receipt

Is only necessary in Austria to deregister the cash register with the tax office. This process must be carried out manually.

Zero Receipt

Are not required in Austria, but can be created if necessary.

How do I generate a closing receipt?

Please only do this after closing time

- Locate the POS where the EFR is installed

- Open the browser (Google Chrome or Firefox)

- Enter localhost:5618 in the address bar

- Click on the “Control” tab

- Then continue by clicking on the “Decommission cash register” button

The next day, a new starting receipt is automatically created with the first transaction. This ensures that the tax authorities have processed the final receipt and that the cash register is registered correctly again.

How do I create exports in the efsta Portal?

- Navigate to the “Portal Export” menu

- Select the desired export type in the drop-down menu

- Choose the organization/company you need

- Enter the required time period for the export

- You can display the export as a preview or download the entire export with all data

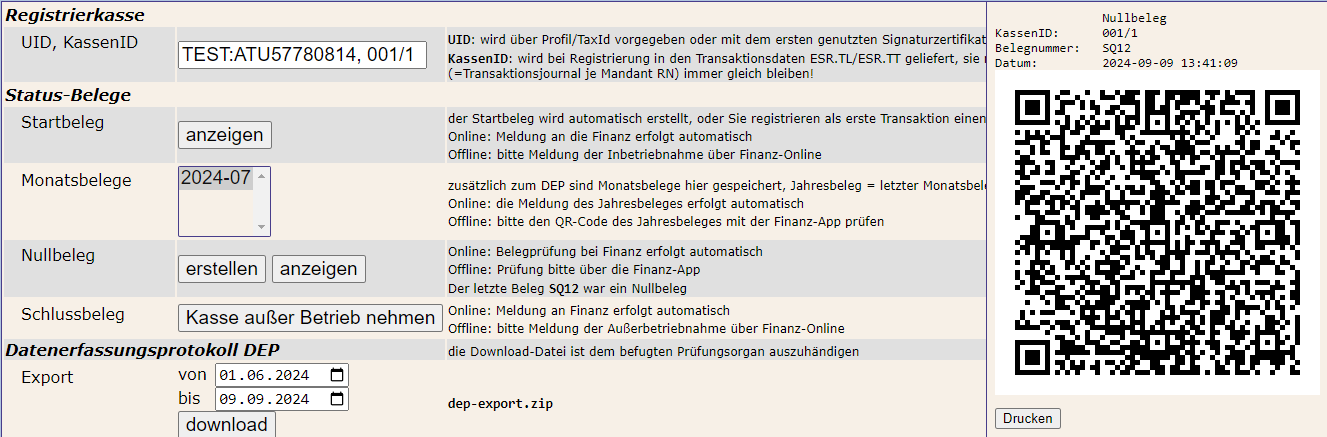

How can the QR code be displayed locally?

- Locate the POS where the EFR is installed

- Open the browser and enter localhost:5618 in the address bar

- Navigate to the “Control” tab

- In the “Status documents” field, you can display the desired documents as a QR code

How can I change certificates?

Expired certificates can still be used for signing. However, we recommend ordering a new one from efsta to avoid future errors on the part of the signature provider.

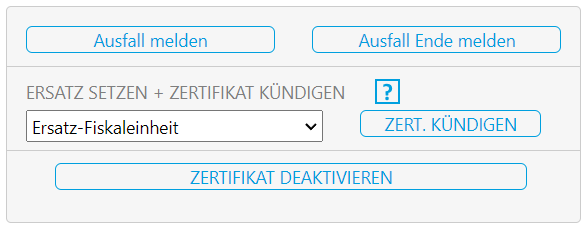

Hardware signature

If you order a new hardware signature, you can unplug the old certificate locally upon receipt and deactivate it in the portal.

Cloud signature

If you order a cloud certificate, you can then click on the 3 dots next to the certificate in the portal, select the new certificate and click on “Cancel certificate”. This cancels the old certificate and the new one is used.

FON

How do I connect a webservice user for cash registers?

To use the Finanz-Online web service, please create a special “Web service user for cash registers” in the Finanz-Online web portal according to the instructions. You can read more about this process here.

Please note that only one such FON web service user is permitted per company (UID).

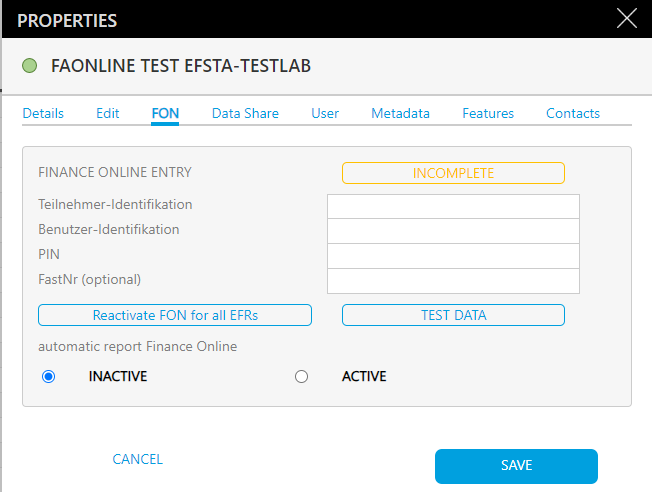

- Once you have created the access data, navigate to the company level in the efsta Portal and select the desired company.

- To the right of the company, click on the

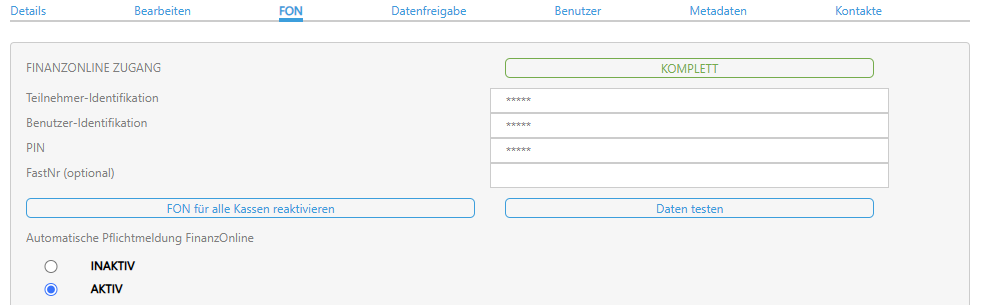

<...>icon to open the properties window. - There, click on the FON tab and fill in the fields with your previously created access data.

- Then save and click on Test data.

- If the entry is correct, activate the automatic mandatory message toFinanz Online by clicking on ACTIVE.

- Save your entries.

If the cash register was started incorrectly, e.g. the start receipt was transmitted before the FON data was activated, the last message (e.g. start receipt) can be repeated by clicking on “Reactivate FON for all cash registers”.

Most frequent problems with the FON webservice

- Instead of the “Web service user for cash registers”, Finanzonline access data is entered in the portal.

- The company's UID entered in the Portal does not match the UID on the smartcard (certificate).

- Start receipt/zero receipt could not be created. (Contact cash register manufacturer)

Solution

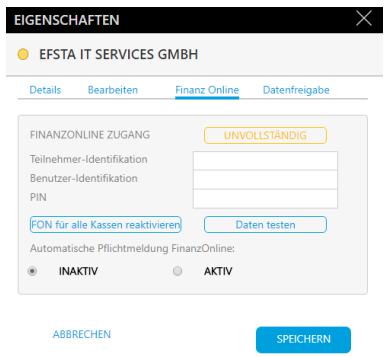

- Open the properties window of the desired company, go to the “Finance online” tab

- Enter your data there and click on “Test data”

- If the access data is correct, “COMPLETE” is displayed in green; if it is incorrect, “Incorrect” is displayed in red

- If the data is incorrect, a red error message from Finanz Online will also appear under the “Test data” button

- The status calculation may take some time

- You can refresh the display by moving the mouse over the respective color or reloading the browser

Error messages of webservice user access data

Code 0: Call ok

Code 1: The session ID is invalid or has expired.

Code 2: It is currently not possible to access the web service due to maintenance work.

Code 3: A technical error has occurred.

Code 4: The transmitted access data is invalid.

Code 5: User blocked after several failed attempts.

Code 6: The user is blocked.

Code 7: The user is not a web service user.

FON messages and their meanings

| Status Color | Meaning |

|---|---|

| Everything OK; cash register is fiscalized correctly | |

| There is a temporary problem; no immediate user action required; check again later | |

| Problem with the fiscalization of the cash register; immediate user action required |

| Status | FON Message | Description |

|---|---|---|

| FON login failed | FON message could not be reported to FinanzOnline. Please use a FON web service user and check the access data. | |

| FISCAL_AT-START-REGSE-7-P-The order term in the certificate is not assigned to the registering company. Please contact your trusted service provider. | The UID/tax number in the certificate (smartcard or remote certificate) does not match the UID/tax number in Finanz Online. Check the Finanz Online account and your certificate. | |

| FISCAL_AT-START-BELEG--P- | A start document was successfully reported in the productive Finanz Online. P stands for productive in all messages. | |

| FISCAL_AT-START-BELEG--T- | A start document was successfully reported in the FinanzOnline test environment. For all messages, T stands for Test | |

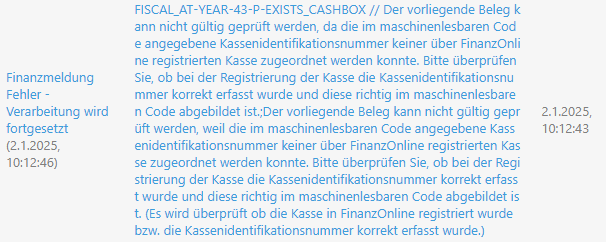

| FISCAL_AT-START-BELEG-43-P-EXISTS_CASHBOX | Another register with the same cash register ID already exists. The cash register ID must be unique for Finance. Please note that if you deregister this register with Finance, you could also deregister other productive registers with the same cash register ID. | |

| FISCAL_AT-START-BELEG-43-P-RECEIPT_FULL/STATE_CONSOLIDATED | Error during the start document check. Please check whether there is another register with the same cash register ID. | |

| FISCAL_AT-START-BELEG-43-P-RECEIPT_FULL /TYPE_OF_RECEIPT | Error during the start document check. Please check whether there is another register with the same cash register ID. | |

| FISCAL_AT-SR-START-7-The order term in the certificate is not assigned to the registering company. Please contact your trust service provider. | The UID/tax number in the certificate (smartcard or remote certificate) does not match the UID/tax number in Finanz Online. Check the Finanz Online account and your certificate. | |

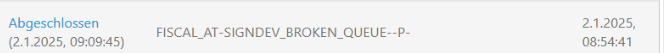

| FISCAL_AT-SIGNDEV_BROKEN_QUEUE--P- | The EFR could not find a security device. Please check whether a security device (smart card or Internet connection for remote certificate) is available. | |

| FISCAL_AT-SIGNDEV_BROKEN_ISSUE--P- | The failure of the security device has now been out for more than 48 hours, so the failure has been reported to Finanz Online. | |

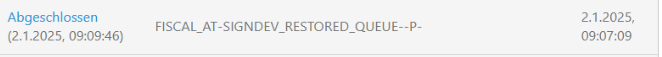

| FISCAL_AT-SIGNDEV_RESTORED_QUEUE--P- | The EFR has found a safety device again. | |

| FISCAL_AT-SIGNDEV_RESTORED_ISSUE--P- | If the failure of the safety device was reported, the end of the failure is now reported to Finanz Online. | |

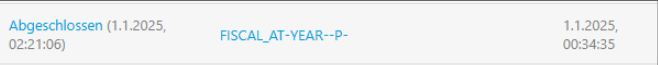

| FISCAL_AT-YEAR--P- | An annual document has been successfully reported in the productive Finanz Online. P stands for productive for all reports | |

| FISCAL_AT-YEAR--T- | An annual document was successfully reported in the FinanzOnline test environment. T stands for test in all messages. | |

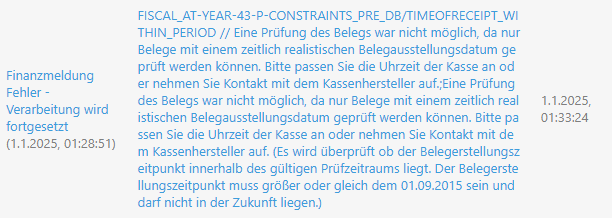

| FISCAL_AT-YEAR-43-P-CONSTRAINTS_PRE_D B/TIMEOFRECEIPT_WITHIN_PERIOD | The annual document was registered with an unrealistic date | |

| FISCAL_AT-YEAR-43-P-EXISTS_CASHBOX | The verification of the annual document is incorrect because this cash register was not registered in Finanz Online for document creation. | |

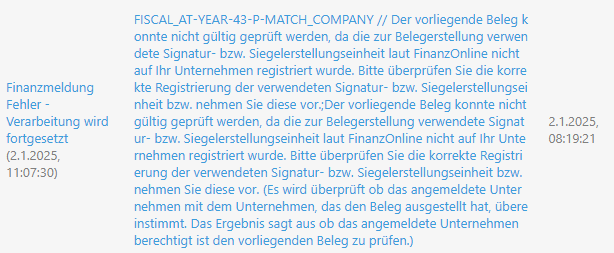

| FISCAL_AT-YEAR-43-P-MATCH_COMPANY | The UID/tax number in the certificate (smartcard or remote certificate) does not match the UID/tax number in Finanz Online. Check the Finanz Online account and your certificate. | |

| FISCAL_AT-YEAR-43-P-RECEIPT_FULL/FORMAT | Format of the annual receipt is incorrect. Please note that the character “_” is prohibited in the location number, cash register ID and transaction number. | |

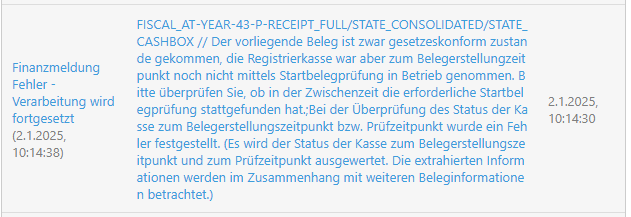

| FISCAL_AT-YEAR-43-P-RECEIPT_FULL/STATE_ CONSOLIDATED/STATE_CASHBOX | The verification of the annual document is incorrect because this cash register was not logged into Finanz Online at the time the document was created. | |

| FISCAL_AT-YEAR-43-P-RECEIPT_FULL/STATE_ CONSOLIDATED/STATE_SIGDEVICE | The verification of the annual document is incorrect because the security device failed at the time the document was created. Please check the security device. | |

| FISCAL_AT-CLOSE--P- | Cash register was successfully logged off in productive Finanz Online. P stands for productive in all messages. | |

| FISCAL_AT-CLOSE--T- | Cash register has been successfully logged off in productive Finance Online. T stands for Test | |

| FISCAL_AT-EFSTA-CHECK-CASHREG-OK-0-P- | Regular query as to whether the cash register is still logged into FON was successful. | |

| FISCAL_AT-EFSTA-CHECK-CASHREG-NOTOK-0 -P | Regular query as to whether the cash register is still logged on to FON was unsuccessful. Cash register is no longer registered in the FON. Please check whether other registers with the same cash register ID exist. |

RKSV & SEE

What is the RKSV?

The RKSV (Cash Register Security Ordinance) is a regulation in Austria that obliges companies to use electronic cash registers in order to ensure protection against the manipulation of cash transactions. The aim of the RKSV is to prevent tax evasion and ensure a complete record of business transactions. The RKSV ensures that all relevant data is recorded in a tamper-proof and traceable manner in order to guarantee tax transparency.

How is manipulation prevented by the RKSV?

The RKSV (Cash Register Security Ordinance) uses several technical and organizational measures to prevent the manipulation of data and to ensure the integrity of the recorded business transactions.

What is SEE?

From April 1, 2017, all POS systems must have a technical security device (signature creation device - SEE). These signature creation devices can be purchased from a certification service provider that offers qualified signature certificates. Or the Prime Sign certificate can be purchased directly from efsta.

What is a certified safety device (SE)?

A certified security device to fulfill the RKSV is a technical component to ensure that the recorded transactions are tamper-proof. This security device is crucial for the implementation of the RKSV and essentially consists of a signature creation device that ensures that every transaction is digitally signed and thus protected against manipulation. Only signature solutions certified in Austria may be used.

Annual Receipt

Fundamentals about the annual receipt in Austria

Basic Fee

All cash registers active on 01.01. receive an invoice for the entire calendar year at the beginning of the year.

Subsequent Invoicing

Cash registers and transaction overruns started during the year are invoiced on a quarterly basis.

Cash register A (start: 19.12.2024) will be charged in January 2025 for the year 2025. Cash register B (start: 05.02.2025) will be invoiced in April 2025 aliguote until the end of the year and additionally charged for transaction overruns (e.g. 85k in the 1st quarter).

Deactivation

In the event of deactivation (e.g. cash register A on 05.05.2025), no credit will be issued as the minimum term is one calendar year.

Billing at the Start Date

Cash registers that start before the 15th of the month are billed in the following month; if they start after the 15th, there is no subsequent billing

Seasonal Cash Registers

If your cash register is a seasonal cash register, the annual voucher is the last zero voucher/monthly voucher/closing voucher.

How to check the transmission status

-

First, please log in to the efsta portal

-

Navigate to the Fiscal Register (EFR) section

-

Click on the

<...>icon to the right of the desired register (EFR) to open a properties window -

In the Financial Reports tab, you can check the status of your annual receipt and any error messages

If the receipt status says "completed", no further action is required as the annual receipt has been successfully created and checked by FinanzOnline.

The annual receipt was created with a failed security device

The message FISCAL_AT-SIGNDEV_BROKEN_QUEUE--P-indicates that the signature unit has failed during the creation of the annual receipt.

The subsequent message FISCAL_AT-SIGNDEV_RESTORED_QUEUE--P- indicates that the signature unit has been restored.

To solve the problem, please follow these steps:

- Click on the Commands tab in the EFR

- There you will find the “Create zero document” button which you click on

- The Portal then sends a zero document to the EFR, which can be seen as a replacement for the annual document

The cash register is not correctly registered with FinanzOnline

The message FISCAL_AT-YEAR-43-P-RECEIPT_FULL/STATE_CONSOLIDATED/STATE_CASHBOX // means that the cash register is not properly registered with FinanzOnline because no valid start receipt has been generated. It is no longer possible to resend or “repair” the annual receipt.

Follow the steps below so that the cash register is properly registered with Finanz Online again:

Please only do this after closing time.

- Go to where the EFR is installed

- Open the browser (Google Chrome or Firefox)

- Enter localhost:5618 in the address bar

- Click on the “Control” tab

- Finally, click on the “Decommission cash register” button

- The next day, a new start receipt is automatically created with the first transaction.

Due to the new registration of the cash register, no annual receipt is created/required for the previous year. Please document this internally as tax authorities may ask why a correct annual receipt was not created.

The creation time of the annual receipt is incorrect

Here, the annual receipt was created in accordance with the law, but with a time that does not correspond to the actual time.

-

First, please log in to the efsta portal

-

Navigate to the Fiscal Register (EFR) section

-

Click on the

<...>icon to the right of the desired register (EFR) to open a properties window -

Go to Financial Reports

-

Press the button "Reactivate FON" after the time specified in your error message

-

After that, all financial messages are forwarded to Finance. This process may take a few minutes

The user data for the cash register web service user is incorrect

The UID/tax number in your certificate does not match the UID/tax number of the stored “FON user”.

-

First, please log in to the efsta portal

-

Navigate to the Companies section

-

Click on the

<...>icon to the right of the desired company to open a properties window -

Navigate to the "FON" tab

-

Please check the certificates and data you have entered are correct

-

Save and press the “Reactivate FON for all cash registers” button. This will forward all messages to the FON user you specified

-

If it turns out that your signature belongs to a different company (UID change), please order a new signature for the correct company

My cash register was not correctly registered with FinanzOnline

The check of the annual receipt is incorrect because this cash register was not logged into FinanzOnline to create the receipt.

-

First, please log in to the efsta portal

-

Navigate to the Fiscal Register (EFR) section

-

Click on the

<...>icon to the right of the desired register (EFR) to open a properties window -

Go to Financial Reports

-

Press the button "Reactivate FON"

-

After that, all financial messages are forwarded to FinanzOnline. This may take a few minutes

-

Should the problem persists, you will need to log the cash register off and back on again

Once this is finished, proceed with the steps below so that the cash register is properly re-registered with Finanz Online.

Please only do this after closing time.

- Go to where the EFR is installed

- Open the browser (Google Chrome or Firefox)

- Enter localhost:5618 in the address bar

- Then click on the “Control” tab

- Then click on the “Decommission cash register” button

- The next day, a new start receipt is automatically created with the first transaction

Due to the new registration of the cash register, no annual receipt is created/required for the previous year. Please document this internally as tax authorities may ask why a correct annual receipt was not created.

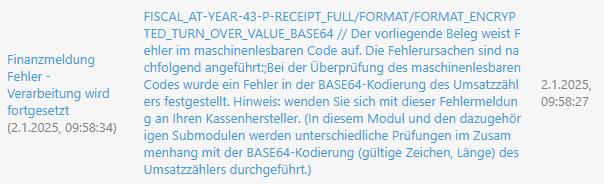

The sales counter is incorrect

The sales counter has been calculated incorrectly due to an error. There may be various reasons for this.

To solve the problem, please proceed as follows:

Please only do this after closing time.

- Go to where the EFR is installed

- Open the browser (Google Chrome or Firefox)

- Enter localhost:5618 in the address bar

- Then click on the “Control” tab

- Then click on the “Decommission cash register” button

The next day, a new start receipt is automatically created with the first transaction.

Due to the new registration of the cash register, no annual receipt is created/required for the previous year. Please document this internally as tax authorities may ask why a correct annual receipt was not created.