Frequently Asked Questions

General

To whom does the Cash Security Ordinance apply?

The manufacturers of cash registers, cash register systems and software solutions for recording business transactions, such as accounting programs, are responsible for the legally compliant implementation of the KassenSichV - efsta offers the efsta EFR middleware to ensure compliance with the law: Compliance as a Service. Taxable entrepreneurs are also bound by the KassenSichV and, in addition to the legally compliant use of the selected cash register, must also comply with the reporting obligation for cash registers from January 1, 2025!

Who is affected by the reporting obligation?

From January 1, 2025, all taxable persons are required to transmit the electronic recording systems - cash registers - and the TSE(s) they use to the authorities. The taxable person is responsible for reporting the required cash register data. All electronic recording systems within the meaning of Section 1 (1) sentence 1 KassenSichV acquired before July 1, 2025 must be recorded by July 31, 2025 at the latest - including the TSE(s) used

How can be recorded:

- Electronic data transmission will be possible from January 1, 2025 via "My ELSTER" and the ERiC interface.

- All systems of a business premises must be reported uniformly in an XML data file.

How can I change the company's legal name?

- Carry out the daily closing and the TSE export.

- Check whether the recorder is online and all transactions are available in the cloud.

- Uninstall EFR and archive/delete the EFR folder under C:\ProgramData\EFR

- Deactivate EFR and all old companies in the efsta portal

- Create the new company in the portal

- Reinstall EFR (download here: http://public.efsta.net/efr/ )

- Call with localhost:5618 - Configure profile page (ID,,...)

- Optional: for Cloud TSE - order a new fiscal unit (the assignment is made via the “automatic CloudTSE assignment” by the efsta cloud if the TSE was obtained via efsta; for self-purchased TSEs it must be configured manually).

- Start the checkout process

Please inform your Partner Manager when everything is done so that billing can be switched to the new company and a special termination of the TSE can be initiated.

TSE

What is a TSE?

The technical security device (TSE for short) is the legally required security module in electronic cash registers that ensures the complete and unalterable recording of all cash register transactions.

How do I order a TSE in the efsta portal?

To comply with the KassenSichV, you need a certified TSE. You can purchase this directly via the efsta portal. Please contact your cash register manufacturer to make sure which TSS is compatible with the cash register system or cash register software.

- Go to the “Orders” menu in the efsta Portal

- Select the desired company from the drop-down menu

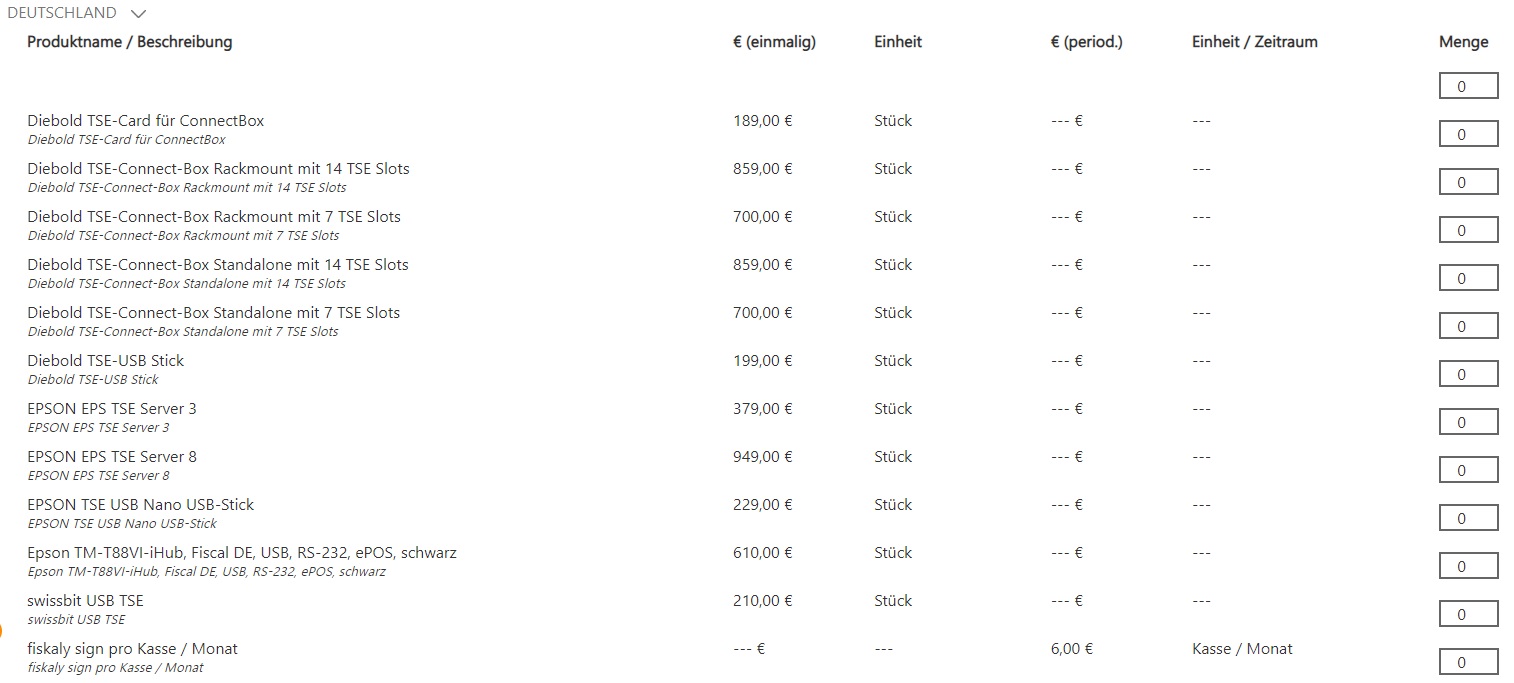

- Select the desired product for Germany

- Enter the number of TSEs required

- Read and confirm the terms of use

- Click on “Next”

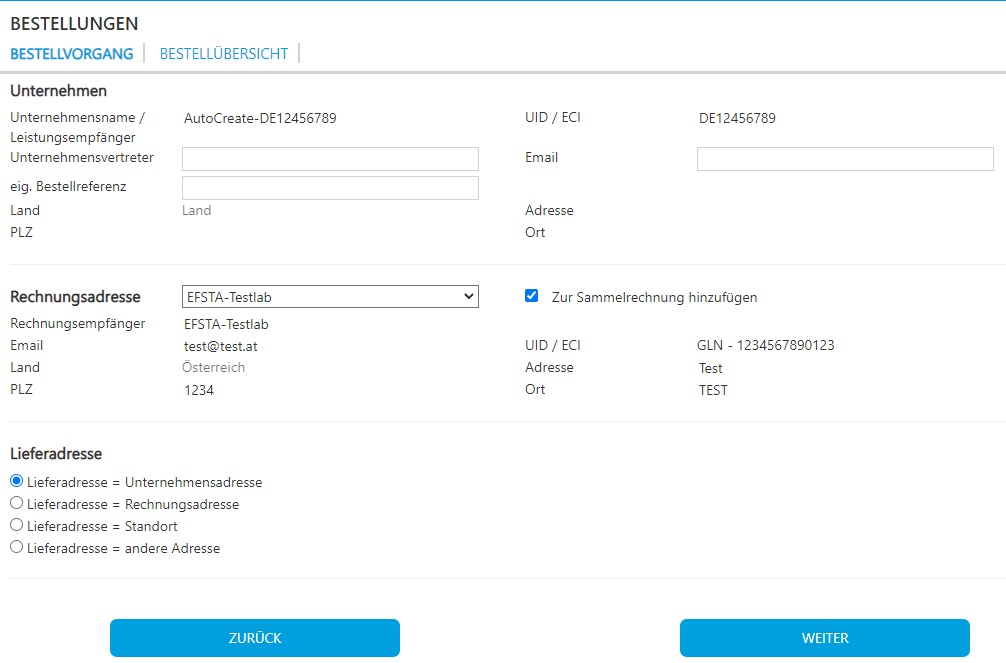

- Enter the company address and select the stored billing address (this must be stored in the company master data beforehand). You can change the delivery address if necessary

- Then click on “Next”

- You will receive confirmation that the order has been successfully completed

Ordering a cloud TSE

The Cloud TSE is available in the efsta Portal approx. 15 minutes after ordering.

The order is processed and dispatched by the efsta sales team. You will receive an order confirmation and an invoice by email. The delivery time is approx. 2-4 weeks. After receipt, you or your cash register manufacturer can install the hardware.

Ordering a hardware TSE

The order will be processed and dispatched by the efsta sales team. You will receive an order confirmation and an invoice by e-mail. The delivery time is approx. 2-4 weeks. After receipt, you or your cash register manufacturer can install the hardware.

How can I deactivate a TSE in the efsta portal?

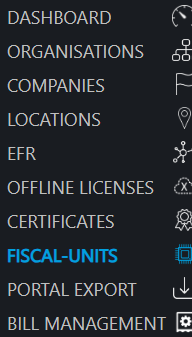

- Navigate to the Fiscal Units section and select the desired TSE

- Click on the

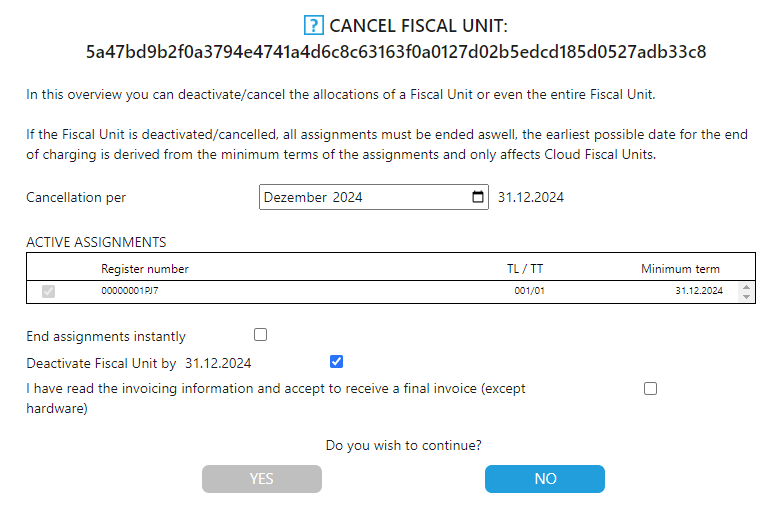

...symbol next to the TSE to open the properties window - There, select the “Deactivate fiscal unit” button, which opens the pop-up window

- There you will see the tab to which the TSE is assigned

- You have the option of canceling the TSE or, if it is still to be used, just ending the assignment

- Confirm your selection

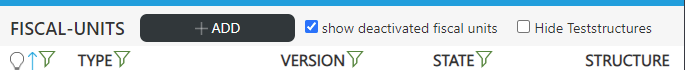

Deactivated TSEs are only visible in the Portal if you activate “Show deactivated fiscal units”.

How can I exchange a TSE?

Depending on whether the TSE is a hardware- or cloud type, there are two processes to replace a TSE.

We recommend that you provide the new TSE in advance before a planned TSE exchange. You are welcome to order TSEs via the efsta portal under the calculator icon. Hardware TSEs have a delivery time of around 2 weeks, while cloud TSEs are available immediately after ordering.

Replacing hardware TSEs

-

Send a daily closing (

NFS=Z) to the EFR -

Disconnect the existing TSE from the device

-

Log into the efsta Portal and search for the relevant TSE by clicking on the "Fiscal Units" tab

-

Click on the

<…>icon to the right of the TSE to be replaced -

Select the “Deactivate fiscal unit” button. In the following window, you can deactivate the TSE

-

Plug the new hardware TSE into a free USB port (for SD card TSEs: into the card reader)

-

The TSE should be automatically recognized and assigned by the EFR, but if not:

- open the EFR (http://localhost:5618) > “Control” menu > ��“TSE”

- select the TSE from the list and click on “Set assignment” -

(Optional) In the EFR interface at “Profile” > “Attributes,” enter your own values for:

- TSE_AdminPin

- TSE_AdminPuk

- TSE_TimePin

- TSE_TimePuk

- TSE_ClientId

(Without adjustment, the TSE automatically initializes the default values) -

Epson TSE only:

Windows needs an additional driver which can be downloaded at the EPSON website

Replacing Cloud TSEs

- Send a daily closing (

NFS=Z) to the EFR - Log into the efsta Portal and search for the relevant TSE by clicking on the "Fiscal Units" tab

- Click on the

<…>symbol on the right-hand side of the TSE to be exchanged - Select the “Cancel fiscal unit” button

(Please note the applicable cancellation periods) - In the following window, you can choose whether you want to simply end the assignment to the register or deactivate the TSE

- Choose the desired TSE in the Portal under “Order”. After approx. 10 minutes, the new Cloud TSE will be automatically assigned and allocated to a free EFR

- The TSE will be configured during the next heartbeat (approx. every 15 minutes). It will be initialized and used within the next 1–3 transactions

The reporting obligation stipulated in the KassensichV requires that any change to a TSE used must be reported in MeinElster within one month.

We fulfill this obligation using our notification service. With the free notification service from efsta, the Elster contact stored in the efsta Portal always receives an email on the following Monday informing them that an XML file is available for processing due to the new TSE, or if using our fee-based automated reporting service, the email will notify them when a new report as been created. Details can be found on the page Mandatory Reporting

We recommend that you include the exchange of a TSE in your procedural documentation and file the confirmation on MeinElster.

How does the cloud TSE assignment work?

- Approx. 15 minutes after ordering the Cloud TSE, the TSE is available in the efsta portal.

- It can be used immediately. (no delivery times)

- With the first transaction, the TSE is automatically assigned by the efsta Cloud.

- The TSE status can be seen under the menu item Fiscal units in the efsta portal.

KassenSichV

What does the KassenSichV mean?

The Cash Register Security Ordinance (KassensichV) is an ordinance of the Federal Ministry of Finance (BMF) that prescribes new mandatory standards for the prevention of manipulation of cash registers. This ordinance defines the technical specifications for electronic recording and security systems, such as cash register or ERP systems. From January 1, 2020, all cash registers in Germany must be equipped with an anti-tampering device, known as a technical security device (TSE).

What is regulated in the KassenSichV?

The aim of the KassensichV is to be able to detect subsequent manipulation of sales data. The verification by means of a data export - which is specified as DSFinV-K - is checked for changes and gaps by the tax office using verification software. Each cash journal entry/transaction is provided with an electronic signature from a technical security device (TSE). If transactions in the journal are manipulated, the chain of signatures is no longer consistent. Checking software can be used to find out at which point the manipulation has taken place at the touch of a button.

What must be recorded according to the KassenSichV?

Since 30.09.2020, cash registers in Germany must be equipped with a so-called technical security device (TSE), which ensures that individual records must be kept. The TSE signs and saves the cash register transactions on its internal memory and returns a code to the cash register. This code must be printed on every sales receipt. The data is stored in an unchangeable log (TSE TAR file), which must be exportable for the tax office. The electronic recording system must start a transaction for each business case that records the following data:

- Time of the start of the process

- a unique and consecutive transaction number

- Type of procedure

- Data of the procedure

- Type of payment

- Time of completion or termination

- TSE signature data as QR code or in plain text

DSFinV-K

What's the DSFinV-K?

The abbreviation stands for "Digital interface of the tax authorities for cash register systems". It means that all companies that use an electronic recording system (cash register, POS, ERP system, etc.) must use the same structure for data entry and data export. During an audit by the tax office, the data (DSFinV-K data export) is analyzed for errors/gaps/data inconsistencies by an audit software called IDEA.