Electronic reporting obligation for cash register systems

In accordance with Section 146a (4) AO, cash register systems must be reported electronically to the responsible tax office from January 1, 2025. The reporting obligation for electronic cash register systems in Germany is part of the measures to combat manipulation and tax evasion in the cash register sector.

Key points on the reporting obligation for POS systems in Germany

Reporting to the tax office

Companies that use electronic cash register systems or cash registers with a technical security device (TSE) are obliged to report these systems per business premises to their responsible tax office.

Electronic transmission

The declaration must be made electronically via the My ELSTER portal.

Information on the cash register

certain information must be provided with the report, including:

- type of cash register system and the software

- serial number of the cash register

- details of the technical security device (TSE)

- date of acquisition/commissioning

Deadlines

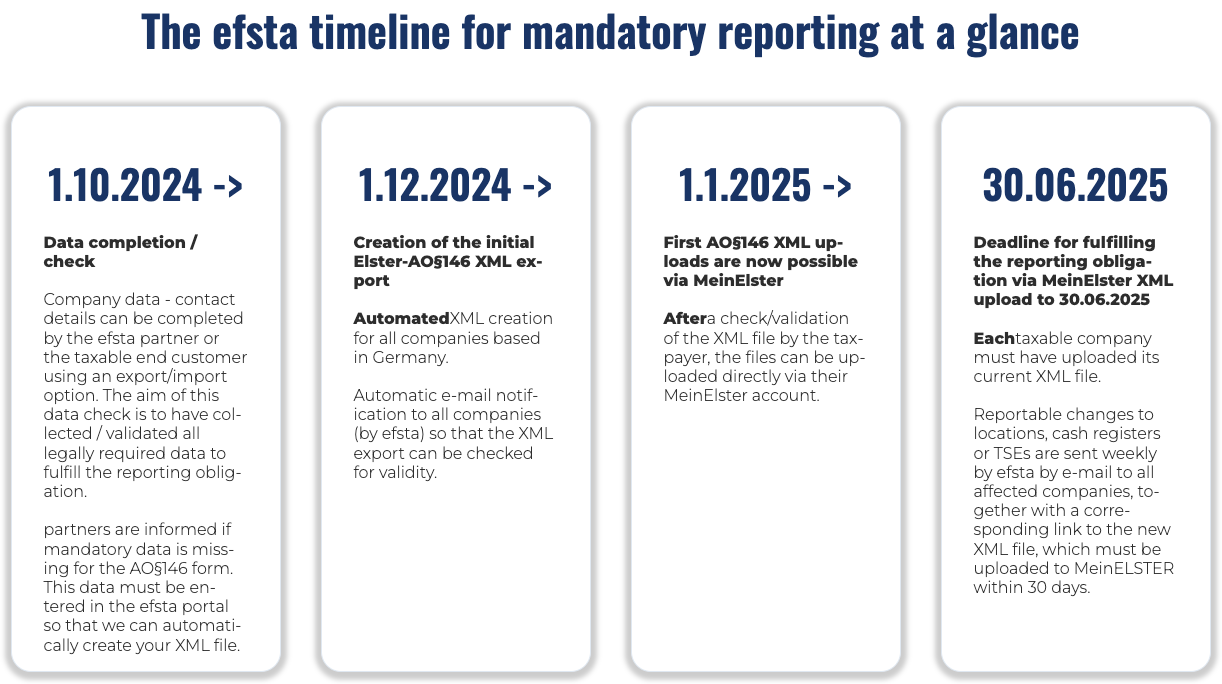

The taxable person must submit the required data from 01.01.2025 with a deadline of 30.06.2025 at the latest. Electronic recording systems that are acquired from July 1, 2025 must be reported within one month (Section 146a (4) sentence 2 AO). This also applies to systems that are decommissioned after this date. Important: When reporting the decommissioning of electronic recording systems, the acquisition must be reported beforehand.

Obligation to use the TSE

All cash register systems must be equipped with a TSE that ensures that all cash register transactions are recorded in a tamper-proof manner and can be made available for audits.

Implementation by efsta

On October 1, 2024, efsta implemented the first step towards fulfilling the reporting obligation required by the KassensichV.

Latest information

All important information about the current implementation of efsta can be found here.